The following rules can pave the way to a successful trading strategy:

Define a strategy

Your strategy should be based on the fundamentals that you have observed or learned in the market.

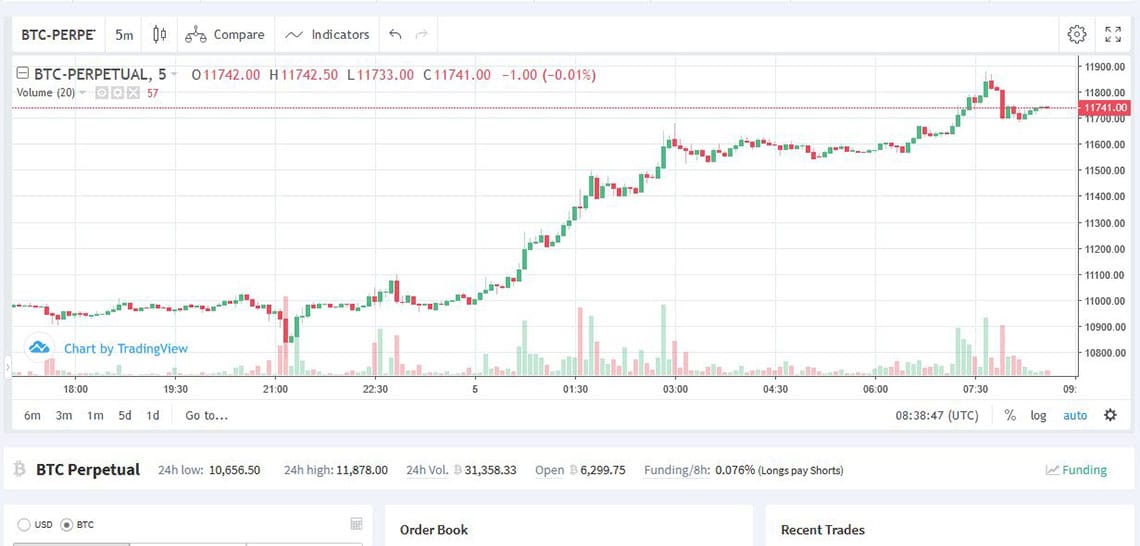

Technical analysis, i.e. the closer examination of price movements, is an important tool for this. Analyze the market and try to discover recurring patterns. Develop a strategy and act accordingly.

Let your go of your emotions

Follow your head, not your gut. Man, by nature, tends to act emotionally. In trading, emotions dominate fear and greed. Try to avoid them by strictly following your plan/strategy. Set loss-limiting limits from the beginning.

Protect your capital

Your capital is your essential tool in order to make potential profits. Keep the proportions you assign to a trade in a reasonable proportion to your capital.

Keep losses small, let your profits run

A successful trader usually has a higher number of high loss trades than profitable trades. However, successful trades are weighted higher in absolute terms.For example, a strategy can result in a 1% loss three times over before a 10% gain in the fourth attempt is achieved. With the help of stop-loss orders or trailing stop-loss orders, losses can be limited and profits can go on a run.

Risk only as much as you can afford to lose

A trade should be in proportion to your trading capital. Do not risk too much. It should be possible to make several loss-making trades without losing a large part of your capital. This also applies to your trading capital. Use only as much as you can afford to lose.

Do not run after the market

The market sometimes moves faster than you can implement your strategy. Do not lose the goal of your strategy if you miss a move. Sit back and wait for new opportunities.

Become a student of the marketplace

Study your strategies and the market regularly. Question and optimize your strategy. Keep a record of your trades to better identify weak points.

There are no gurus with crystal balls

And if they existed, they wouldn’t tell you their strategy! Trust in your own experiences and observations. Ignore people who want to give you a hot tip without being asked.

Be careful with levers

Especially in the crypto market, there are many possibilities to trade with leverage. This means that you can trade with more capital than you have contributed. This can bring obvious advantages, but it is also riskier. The higher the leverage is, the faster the capital can be lost. So it can happen that you assess the trend correctly, but are stopped out due to a countermovement and/or your too large position.

* Originally published in German at CVJ.ch