Credit card company Mastercard announced this week that they will accept “select crypto currencies” as payment. Their focus will primarily be on centralized stable-coins and central bank digital currencies (CBDCs), not Bitcoin & Co.

According to the company, there is no denying that digital assets are taking on an increasingly important role as a means of payment. Through its partner program with crypto companies, it has been possible to make purchases with crypto currencies for some time. Now Mastercard is looking to bring isolated crypto assets directly to their network.

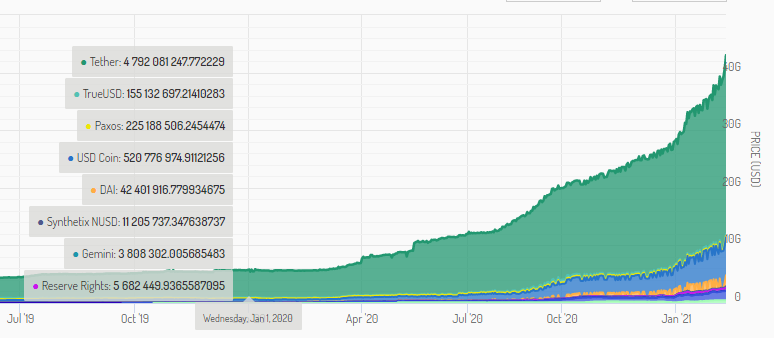

Impressive growth of Stablecoins

Last year, the market capitalization of the entire stablecoin market grew tremendously. Tether (USDT) remains dominant, but fully-regulated competitor USD Coin (USDC) is slowly catching up. This could be related to the regulatory uncertainty surrounding Tether, among other factors.

This fact was also recognized by the U.S. regulator OCC when it granted banks permission to use private stablecoins and Blockchains as infrastructure. Mastercard now wants to use this infrastructure to give its customers a choice.

Our philosophy on crypt ocurrencies is very simple: it’s about choice. Mastercard is not here to recommend that you use crypto currencies. But, we are here to enable customers, merchants and businesses to use digital assets – traditional or crypto. It should be your choice; after all, it’s your money.

Mastercard press release

No “volatile” Crypto Currencies

Accepted assets must meet four criteria, according to Mastercard:

- Consumer protection and privacy

- Know Your Customer (KYC) regulations

- Federally recognized and regulated

- Stability

The last point in particular excludes the majority of all cryptocurrencies, including Bitcoin (BTC) and Ether (ETH). So, it is expected that only fully regulated Stablecoins like Tether (USDT) and USD Coin (USDC) will be accepted. For payments with Bitcoin, it seems that users will still have to resort to the partner program. As a result, some digital asset advocates see no particular added value behind the Mastercard’s decision.

Isn’t the whole decentralized peer-to-peer philosophy designed to cut out the middleman – who charges his own fees for his network? Isn’t the point behind it to simply send and receive digital assets through a cell phone or a simple browser UI?

Patrick Heusser, Head of Trading Crypto Finance AG

Competitor Visa is also primarily focusing on the stablecoin space. A year ago, they filed a patent application for their own crypto currency. In December, they also announced a partnership with Circle, the company behind USDC. How the development of central bank digital currencies (CBDCs) might influence this trend remains to be seen.

*Originally posted at CVJ.CH