DeFi has been a strong driving force for the digital assets’ narrative this summer. Within DeFi there are multiple investment strategies one could adopt. We analyze the performance of different strategies and conclude that active buying and selling of governance tokens was the best strategy.

In the third quarter of 2020, decentralized finance (DeFi) seized a major mind share of the crypto-asset industry. With billions of dollars on public blockchains, the intuitive next step is to generate yield through an on-chain credit system aka the blockchain banking layer. What happened in DeFi this summer is a step ahead in an experiment to transform and banking on the blockchain. We carried our backtesting of three broad investment strategies in DeFi – HODL ETH, Buy/Sell governance tokens, and Yield farm governance tokens.

Introduction to DeFi

DeFi stands for “Decentralized Finance” and refers to the ecosystem of financial applications developed on the basis of blockchain systems, a particular example is Ethereum. DeFi can be defined as the movement that promotes the use of distributed networks and open-source software to develop different types of financial services and products. The idea is to develop and operate open and permissionless financial dApps on the basis of a transparent and trustworthy framework.

DeFi is tinkering with different financial products right from borrowing and lending to derivatives. Currently, this movement is largely enabled by Ethereum blockchain as it offers the compossibility needed for different money legos to interact with each other. Governance of these new money protocols is a major challenge and currently, governance token is the most popular solution. This token allows holders to vote on various proposals and entitles them to a share in profits of the protocol in some cases.

Compound protocol ushered in a norm where the governance token is distributed through a mechanism called liquidity mining wherein the protocol distributes its governance token to users based on their share of liquidity in the protocol. Tokens earned through liquidity mining can be thought of as the yield and therefore liquidity providers (LPs) are also known as yield farmers.

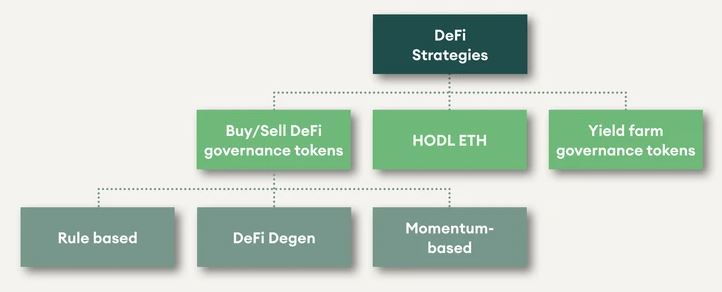

Yield farming activity gave way to a new investment theme in the digital asset ecosystem. Fundamentally, there were three distinct strategies to participate in this investment theme. In this article, we analyze and compare all of them. These are:

- HODL – passively holding ether (ETH)

- Buy/sell DeFi governance tokens – Momentum-based, DeFi-Degen mentality, or Rule-based approach.

- Yield farm governance tokens

We analyzed these strategies over four months from 01 June to 01 October 2020.

Three investment strategies

The following figure shows the different strategies we compare in this article.

HODL ETH

The HODL ETH strategy consists of holding ETH through the four months. Buy and hold is a time-tested investment method that has worked over longer periods. We use this strategy as a benchmark to verify whether there is any merit in more actively managed strategies.

Yield Farming

Another popular way to participate in the DeFi ecosystem is yield farming or liquidity mining. A significant advantage of yield farming over the buy/sell strategy is that investors can provide liquidity in pools such ETH-stablecoin so that they are not swapping ETH or stablecoins for new tokens that are yet to prove their mettle.

Buy/Sell Governance Tokens

The buy/sell DeFi governance tokens strategy is a generic name that encompasses three different ways to trade tokens: (a) DeFi Degen, (b) Rules-based, and (c) Momentum-based buy/sell.

- Degen, short for degenerate, is a term popular on crypto twitter (CT) to address those who switch from one DeFi token to another in a matter of days or even hours in some cases. As we have noticed through this summer, several people invested money into projects that barely had a website let alone a reputable team or a whitepaper. A DeFi Degen is someone who only chases momentum due to FOMO (fear of missing out). DeFi Degen represents an investor who buys the narratives on CT. Notice that if not within the insider DeFi circles, having a sound technical understanding of the protocols is non-trivial. So as stated before, this type of strategy would be purely predicated on hype, FOMO, and spun up narratives. Degen trading is at the end of the trading risk spectrum where risk management is absent.

- On the other end of the spectrum, the rule-based approach is calculative. For this analysis, we decided that one buys when the price crosses 50% of the listing price or the latest low and sells when the price is 30% down from the peak.

- The momentum-based strategy is a bit subjective with a balance between the rule-based approach and DeFi Degen. However, we believe that it stays true to chasing momentum by continuously looking at Twitter and other digital relays. It is not as calculative as the rule-based approach but still adheres to selling when the price drops by approximately 30%. This strategy has a simple premise – how would a portfolio look like if one would just HODL versus actively seeking out alpha returns in a market with no fundamental or technical driven valuations.

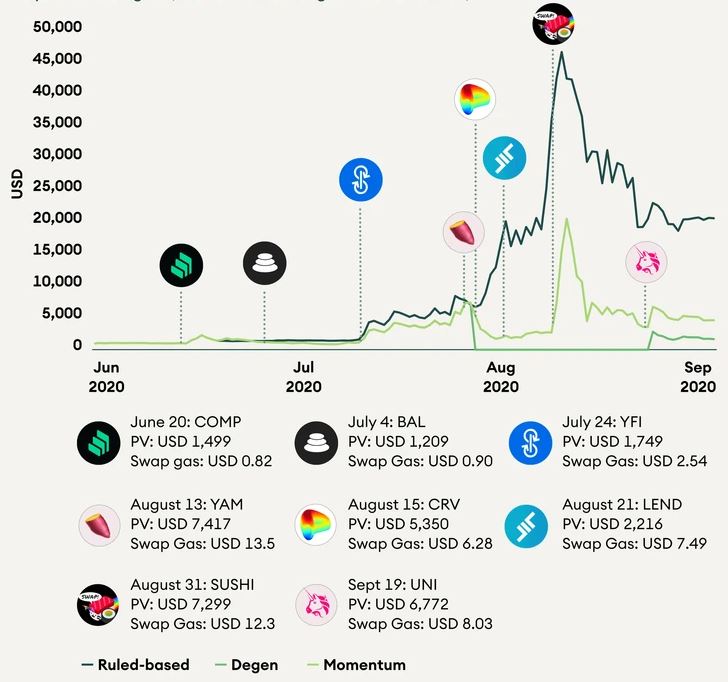

We considered the following tokens for these strategies: BAL (Balancer), COMP (Compound), CRV (Curve DAO Token), LEND (AAVE), SUSHI (SushiSwap), UNI (Uniswap), YAM (yam.finance) and YFI (yearn.finance). These tokens were discussed the most and were among the heavily traded within DeFi.

Comparison of three methods within Buy/sell governance token investment strategy

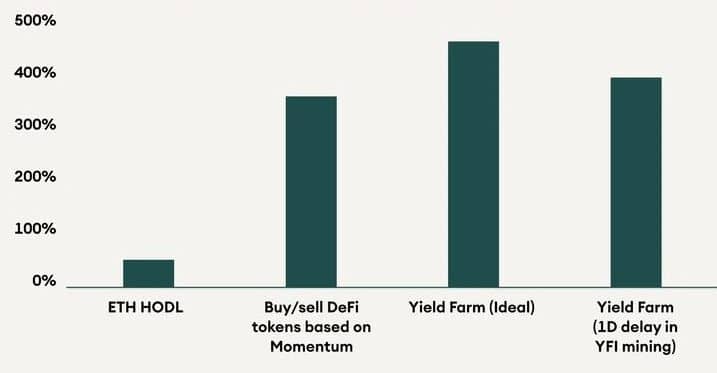

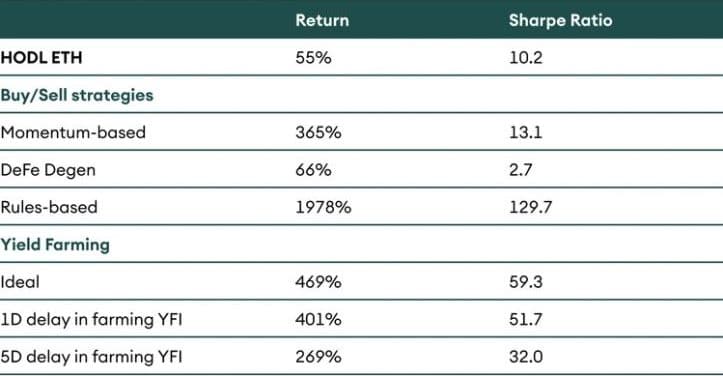

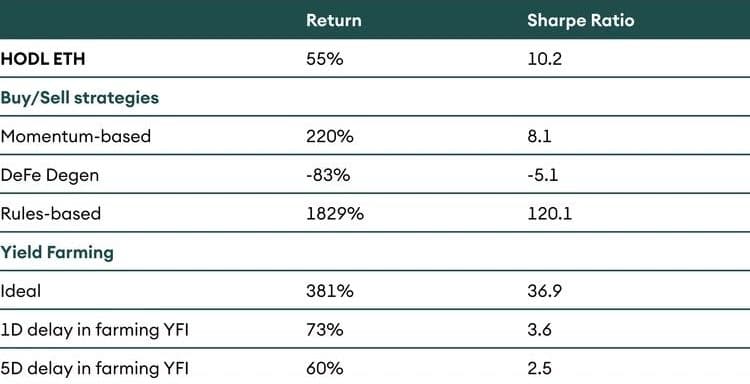

To start our analysis, we imagine an investor with a capital of USD 1,000. The returns for three different methods are a stunning 1978% for Rule-based investment, a mere 66% for Degen and a healthy 365% for momentum-based investment. The only reason the Degen portfolio has a 66% return is due to the UNI airdrop. Figure 2 illustrates the performance of different strategies.

Note that the major difference in three different buy/sell strategies is due to the price performance of YFI. A rule-based approach would not have sold YFI to chase YAM as the former had not dropped by 30% from the peak and the latter had not risen by 50% of its listing day close. However, had the threshold been different (say 20%), the investor might have swapped YFI with YAM. Also, YAM plummeted from USD 138 to almost worthless in just over one day. A DeFi Degen would have lost the entire portfolio due to the YAM fiasco.

The return of the rule-based strategy is driven predominantly by the meteoric rise of YFI price from 0 to USD 40,000 and then settling around USD 30,000 in about 2 months.

Even though the rule-based strategy outperformed the other two, it was extremely difficult to execute. Nobody could have known that YFI would reach USD 45,000 within days after they purchased it at approximately USD 1,500. The most likely scenario is that they would have sold it for a handsome 6X within a month to chase the momentum further with other governance tokens.

While DeFi Degen (high risk) and rule-based approach (low risk) are at the two ends of the risk spectrum within buy/sell strategies, momentum-based strategy poses a moderate risk. And the momentum-based strategy was relatively easier to execute compared to the rule-based approach. If we remove the hindsight-bias, an investor was likely to chase momentum with moderate risk management. Therefore, we think that the momentum-based method best represents the buy/sell governance tokens strategy.

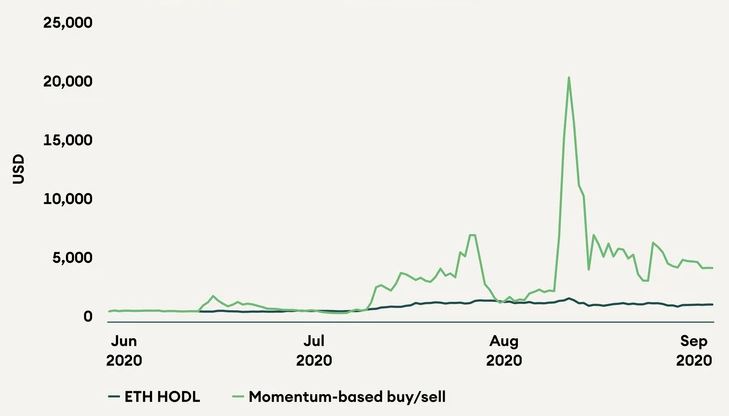

Portfolio performance of HODL ETH vs Momentum-based buy/sell investment strategies

When we analyze the performance of USD 1,000 invested in these two strategies, the momentum-based strategy outperforms holding ETH by approximately USD 3,100 or 310%. Each buy and sell would be conducted as a swap on UNISWAP with UNISWAP’s ERC20-ERC20 fees taken into consideration. In the simulation, these fees did not have much of an impact. But this portfolio was a recipient of the UNI airdrop. We assume if one is holding only ETH, they would not have received UNI airdrop and it makes a difference of USD 1,661 in the final portfolio value.

It is important to note that from the days that were decided to buy and sell into another DeFi token, a 24-hour deviation from that day would not have made that much of a difference except YAM. If the DeFi Degen portfolio held their YAM position for another day into August 14th during the crash, they would have an ending portfolio value in the low double digits.

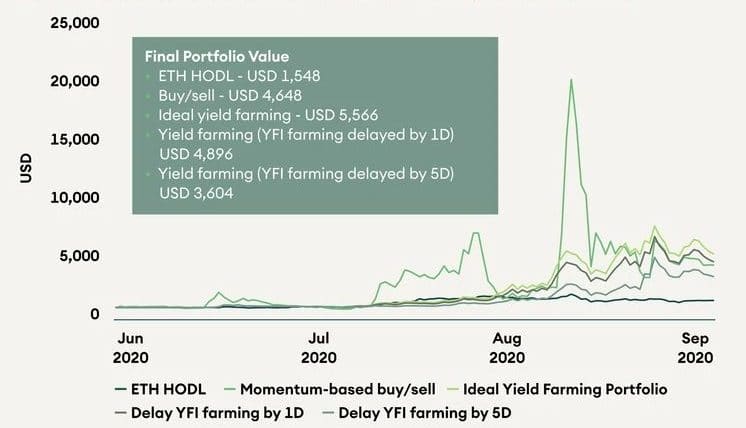

HODL portfolio has a final value of USD 1,548 and while the momentum-based portfolio has a final value of USD 4,648. The Sharpe ratios of the two portfolios with bitcoin as a benchmark are 10.1 and 13.1 respectively.

While the momentum-based strategy offers a superior return compared to HODL, the strategy lost all its advantage twice versus the passive holding one. It means that to fully capture the advantage of this active strategy, the investor must be disciplined and available all the time.

Portfolio performance: HODL ETH and yield farming governance token strategies

An important consideration while yield farming is the transaction fee on Ethereum blockchain. Higher fee deters smaller yield farmers from switching liquidity from one platform to another. We estimate that the investor would have to spend USD 346 in total fee to be able to farm only four tokens.

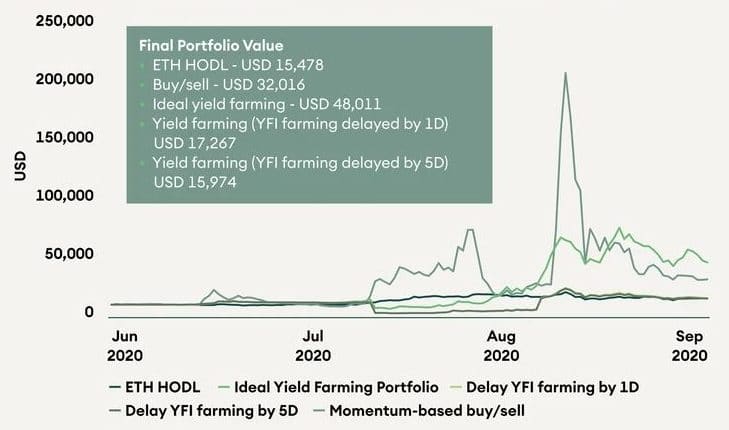

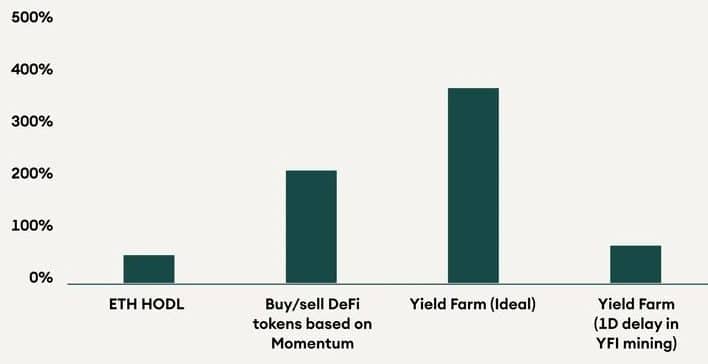

We compare two different portfolio sizes: USD 1,000 and USD 10,000. We considered four protocols – Balancer (BAL), Compound (COMP), Yearn Finance (YFI), and Sushiswap (SUSHI).

We hypothesized that the timing to begin yield farming was vital, especially due to the dramatic increase in the price of YFI. The reason is, Yearn Finance distributed only 30,000 YFI tokens linearly within a few days. Investor’s share of liquidity would have been higher on day one as the total liquidity was only about one-fifth of its peak. Therefore, they would have earned more tokens on day one relative to other days.

As we notice in figure 5, the final portfolio value drops by a whopping 64% if YFI farming was delayed by just one day. In absolute terms, an ideal yield farming would have resulted in the final portfolio value of USD 48,011 as opposed to USD 17,267 in case of one day delay.

Results

irst of all, we want to stress that new projects were launched too quickly for anyone to thoroughly evaluate them. Participating in such projects demanded a thorough knowledge of how protocols interact with each other. For investors with relatively large capital and a good understanding of various DeFi projects, yield farming could have been fruitful. However, the investor had to remain alert all the time to generate optimal results from yield farming. It can be observed that with the constraints, buy/sell technique based on moderate risk management would have fetched the best results.

The reason percentage returns drop significantly with higher capital is the UNI airdrop is worth USD 1,661 in both the cases. Calculations for adjusted-returns for all the scenarios discussed above where bitcoin was the reference suggest that DeFi Degen was the worst choice. As stated earlier if we remove the hindsight bias and assume that investors may not always be available for ideal yield farming, a momentum-based buy/sell strategy, which assumes moderate risk within buy/sell pack would have been the best choice for a portfolio.

Understanding the yield and fee relationship

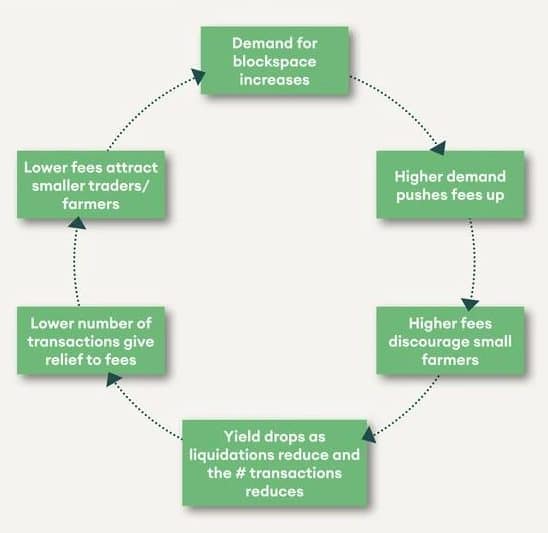

Understanding the yield cycle can help the investor in determining how quickly they should move their capital from one protocol to another. It starts with understanding the demand for block space and then establishing a relationship between yield and fee. The explosion of yield farming activity demands multiple interactions with the Ethereum blockchain and thus, demand for block space increased forcing the gas fees to go through the roof. For smaller yield farmers, gas fees became one of the biggest deterrents to enjoy hunting high yield from one protocol to another. You can read more about how high Ethereum gas fees could be an issue here in this PANews article. Given the fee restriction, small farmers had to be meticulous with their farming activity.

The relation between yield and fee

Before going further, it is vital to understand where the yield comes from. In traditional finance, the yield comes from either liquidations or borrowers creating value from the loan. In DeFi the yield largely comes from the former (when the prices are not increasing all the time) and the standard over-collateralization practice helps in ensuring yield for lenders. The investigation of the source of liquidations suggests that usually, overleveraged or small borrowers are the ones getting liquidated.

Yields drop when the leverage reduces or when the small borrowers stop borrowing. The small borrowers stop borrowing when the fee becomes prohibitive for them to interact with the blockchain. Figure 7 shows the key questions one needs to ask to trace the origin of yield in DeFi systems and figure 8 shows a possible cycle through which fees have an impact on yield.

When fees are high the yields are pushed up and during such times markets are driven by frenzy. During such times investors need to move quickly. This also indicates that markets are overheated and may take a breather. This is exactly what happened during the mania phase of DeFi.

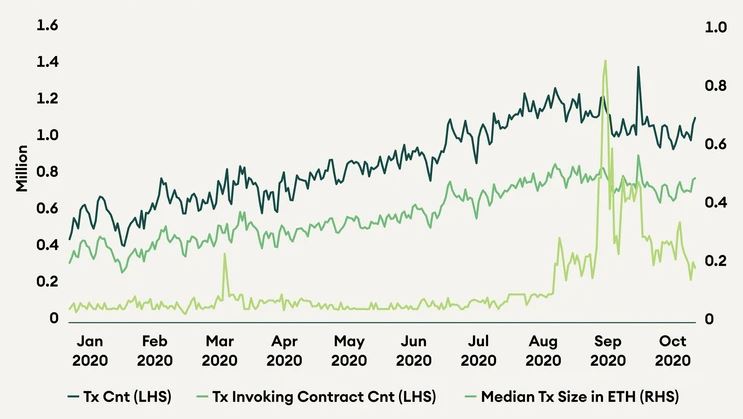

Figure 9 helps in determining where we are in the current cycle. Higher demand for Ethereum block-space during DeFi boom pushed the fees higher. The median transaction size has drastically fallen from 0.9 ETH to 0.2 ETH. However, the percentage of transactions that invoke contract calls has slightly increased suggesting that larger players are still interacting with Ethereum. Though the average fee has reduced (USD 9 to USD 2), it is orders of magnitudes higher than its long-term average (approximately USD 0.1). Further reduction in fees and more exciting projects such as Yearn Finance may be the signs to watch for the next DeFi hype cycle.

Conclusion

Even though our analysis is accountable to variation and could be open to challenge regarding the numbers or time frame used, it does paint a general picture of the different strategies that could have been deployed. Of course, these same strategies could produce different results depending on various time frames and assumptions. However, it does seem that an active strategy with appropriate risk management comes out on top of the passive one. Investors with larger disposable capital can take advantage of yield farming and enjoy relatively lower risk returns.

However, performance from yield farming is heavily contingent upon knowledge and timing. Our observation suggests that DeFi activity has not stopped despite the correction. However, smaller investors seem to be limiting their interactions with Ethereum. This allows bigger players the time needed to carefully evaluate their options before the activity starts inching higher.

This article was written in collaboration with Eric Choy und Saurabh Deshpande.

*Originally posted at CVJ.CH

- Tags:

- Analysis

- Crypto

- DeFI

- Investment