Centralised Exchanges have played a pivotal role in the crypto asset ecosystem, acting as fiat ramps, custodians, exchange, market makers and VCs. Algorithmic smart contract based Decentralised Exchanges (DEXes) offer a non-custodial alternative and have turned into serious competition.

Bitcoin started in 2010 as the first crypto asset, and the only way to acquire it initially was through mining or transacting with a miner. Mt. Gox, launched in July 2010, soon became the leading exchange to buy and sell bitcoins for US dollars. Enthusiasts did not have to mine or barter with miners to acquire bitcoin anymore. As the crypto universe grew and more assets populated the space, exchanges became increasingly pivotal as facilitators of transactions between crypto assets and against fiat.

Today, about 300 exchanges support more than 8’000 crypto assets and 35’000 fiat and crypto pairs. New tokens are launched and listed every day, and exchanges play a crucial role in promoting the token and its price discovery.

The Mt. Gox scandal

Mt. Gox infamously filed for bankruptcy in 2014, losing its customers 650’000 BTC, valued more than USD 450 m at the time and USD 32 bn today. This served as a landmark case for the crypto world for two reasons – a black swan event would not mean there will be an extra-blockchain event to compensate the affected parties, and secondly, it exposed a vulnerability in the ecosystem where although the blockchain is impenetrable, the participants and custodians are not.

Crypto asset exchanges provide services greater than those of exchanges in traditional finance, acting as brokers, market makers, custodians, investors and of course, the exchange platform. They hold and control an immense amount of value with little regulatory oversight and are prime targets for hacks and frauds. It was the Mt. Gox scandal that gave rise to the idea that if you are not the sole owner of the private keys to your wallet, it is not your crypto asset; in other words, “not your key, not your cryptocurrency”.

However, there was no clean solution available, with P2P having its flaws. Centralised exchanges (CEX) that replaced Mt. Gox, like Bitfinex, Poloniex, Kraken and Bittrex, remained central to the crypto world even while some suffered their own non-fatal breaches. The possibility of a non-custodial trustless exchange grew with developments on Ethereum and utilising the power of its smart contracts.

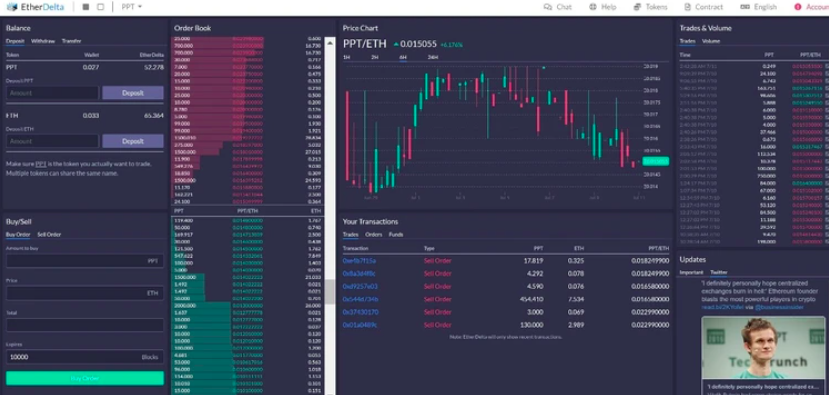

Etherdelta, the first DEX on the Ethereum blockchain

During the Initial Coin Offering boom in 2017, with the launch of hundreds of new projects, the market need for a decentralised exchange (DEX) for free and permissionless listing also grew. Etherdelta, the first DEX (see picture 1), allowed the trustless transfer of crypto assets using Ethereum’s smart contracts and tried to fill this market need.

However, Etherdelta’s UX was slow and clunky, with investors first needing to transfer assets to the exchange contract and all orders, fills, and cancellations being settled on the blockchain. There was also limited liquidity. Subsequently, there were attempts by the teams at 0x, Bancor and Kyber Network; however, no solution was elegant enough to gain serious traction.

Relay by 0x had similar problems to Etherdelta with slow order flow and low liquidity, Bancor and KyberSwap needed central approval for listing and transacting, and because of lack of traction, they had high spreads. There was also the problem of needing a CEX to move value between crypto asset and fiat as they only allowed for transfer between assets on the Ethereum blockchain.

Modern DEXes

Uniswap launched its upgraded version 2 in 2020 and became the first major DEX to provide a serious and decentralised solution to compete with centralised exchanges. It works as an Automated Market Maker (AMM) and has led the DEX space in users and volumes since. Following Uniswap’s lead and model, other exchanges have come up offering similar services and filling the gaps in Uniswap’s model.

The success and popularity of DAI and USD-equivalents like USDT, USDC and wrapped assets like WBTC enabled value transfer between assets on the Ethereum blockchain with fiat and BTC, allowing investors to at least change the risk profile of their portfolio if not exit the space entirely. The assets remain in the users’ custody, and any exchange is settled within a single block with traders acting as “takers” to the Liquidity Provider “makers”.

We cover the types of modern exchange and the function they serve in a trustless system.

Constant Product AMM

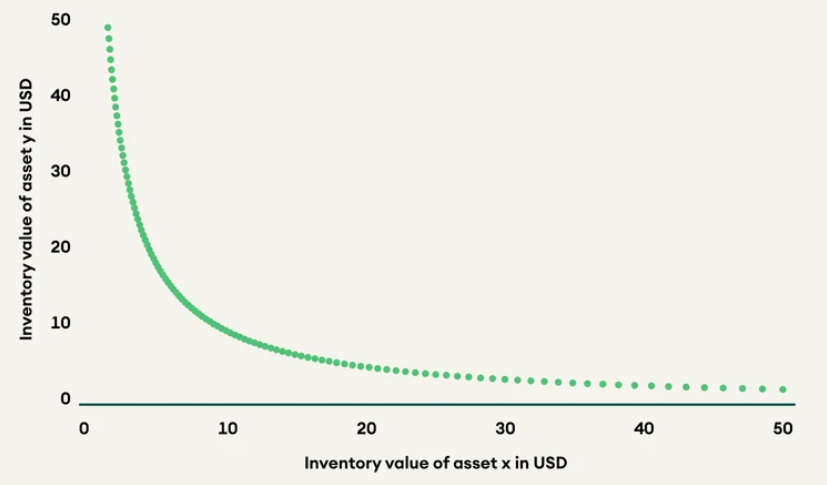

Popularised by Uniswap, automated market makers (AMMs) are the most popular type of DEX. Instead of using order books, assets are priced algorithmically using a constant product formula xy=k. Liquidity providers (LPs) pool their tokens against which traders can input their trades and earn a fraction of the trade value as fees. The product of the pool of tokens (xy) must remain the same after the trade (i.e. equal to the constant k), which is why it is called the “constant product formula”.

We use an example to illustrate how this works. To trade between ETH and USDC, assume a price ratio of 1 ETH to 2’000 USDC and a pool of 500 ETH and 1’000’000 USDC available in the liquidity pool. Here the k constant product value is 500’000’000. The contract will accept any transactions such that the product xy remains equal to k, i.e., to buy 10 ETH, ~20’408 USDC will have to be supplied (490 ~1’020’408 = 500’000’000) with the new price being 1 ETH = ~2’082 USDC. The slippage is directly proportional to the order size and inversely to the size of the liquidity pool.

This model has worked well for billions of dollars locked by LPs and traded by traders. However, it generates “impermanent loss” for the LPs. Impermanent loss is the fictitious loss suffered by liquidity providers for providing liquidity instead of holding the tokens separately. We continue the above example to illustrate this. For an LP who contributed 10% of the total pool, meaning initial ownership of 50 ETH and 100’000 USDC, the initial net worth is 200’000 USDC at 1 ETH = 2’000 USDC. Post-trade, the LP owned 49 ETH and 102’041 USDC, with a net worth of 204’081 USDC at 1 ETH = ~2’082 USDC.

Had the LP held 50 ETH and 100’000 USDC, their net worth would be 204’123 USDC at 1 ETH = ~2’082 USDC. The difference of 42 USDC is known as impermanent loss. This loss goes to zero if the ratio returns to what it was at the time of providing liquidity, giving it the moniker impermanent loss. At this point, the fees earned by the LP would be pure extra profits versus holding the coins separately.

Uniswap is an Ethereum-based exchange, allowing swaps between ERC-20 tokens on the base layer of the Ethereum blockchain. Similar models have been implemented to other platform chains like PancakeSwap for Binance Smart Chain and Raydium for Solana. Newer projects like Loopring AMM allow for swaps on Ethereum layer 2 and Thorchain is building a cross-chain AMM.

Constant Sum Model for Similar Assets

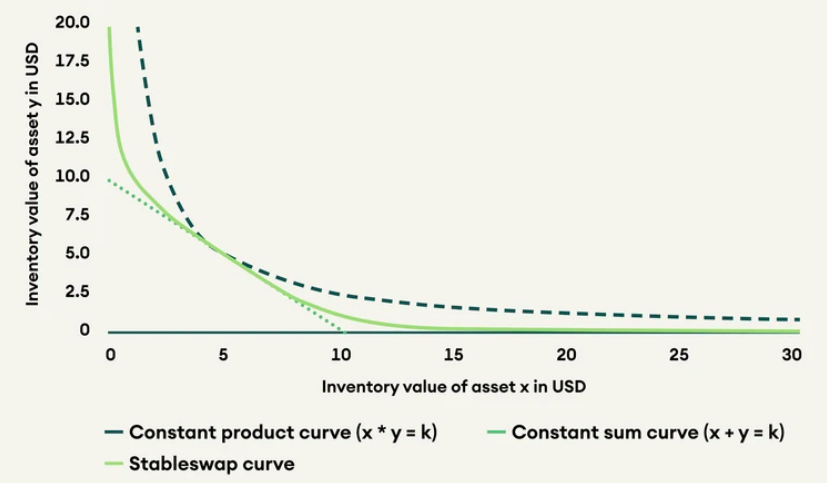

The constant product AMM has different relative prices at all inventory levels and, therefore, does not work well for highly correlated assets, like wrapped tokens, synthetic tokens, and stable coins. For this, Curve pioneered a modified constant sum model, which allows for a 1:1 exchange for most inventory levels.

As illustrated in figure 2, the modified constant sum model is linear with the same slope for a large part of the curve allowing for a constant exchange rate, while the constant product model has a variable slope and a variable exchange rate at every point. Only at extreme inventory levels is the price is considered de-pegged from the other pool asset, and the price is allowed to change.

The constant sum model allows for large transactions with low slippage in “similar” assets stable coins such as TUSD, USDT, USDC and DAI or wrapped and synthetic tokens such as WBTC, renBTC and sBTC. Since the price typically stays within a range, impermanent loss is not a feature of “stableswaps”. LPs earn transaction fees while accepting the risk of a de-pegging of an asset.

NFT Exchanges

Rarible and OpenSea allow for the purchase and sale of art non-fungible tokens or NFTs. Art NFTs are unique tokens that may carry unique qualities and also have an audio/visual output. Bids and asks, therefore, need to be matched 1:1 for NFTs as the tokens are unique. Uniswap-like AMMs can only trade fungible assets as the assets are pooled and priced the same, having no differentiation from one another.

Aggregators

Ethereum has multiple DEXes like Uniswap, Sushiswap, Kyberswap and Curve, with different models, different liquidity depths (defined by the value k) and, consequently, different slippages. With multiple competing exchanges, it becomes difficult for users to find the exchange offering the best price. Aggregators have come up to help the user find the best rate across DEXes.

Some of the more popular implementations are 1inch, Metamask, Zerion and 0x. Aggregators automatically find the best price for the users from the underlying DEXes, even splitting the order among the DEXes to ensure the lowest slippage and transaction cost, as seen in picture 2.

The Case for Decentralised Exchanges

Now that we understand the different types of decentralised exchanges, it is also important to understand the need for them and what makes them better than centralised custodial exchanges.

Not your key, not your cryptocurrency

Those who have been in the crypto asset space long enough and have unfortunately been hit with hacks and breaches of trust learned the hard way the meaning of the phrase “not your key, not your cryptocurrency”. In our opinion, this reason alone is sufficient to support the case for decentralised exchanges. Having control over your assets without a central regulatory authority is one of the fundamental values that brought about bitcoin and the ecosystem.

Whether it was Mt. Gox in 2014 losing 650’000 BTC, now worth USD 35 bn or Kucoin in 2020 losing funds worth USD 250 m, or Binance in 2021 removing ETH withdrawals during times of high gas prices, there is always some risk associated with trusting the custody of valuable crypto assets with third-party exchanges.

With every bull run, the value deposited in custodial exchanges skyrockets, and they naturally become high priority candidates for any malicious actors. Unlike traditional assets where a regulator may return funds to an aggrieved party, blockchain technology makes it so that stolen funds are rarely recovered. The only safe way to store funds is with oneself and following the ethos of blockchain, “not your key, not your cryptocurrency”. It only takes one hack or loss of funds to put users off custodial solutions, but perhaps it does take one hack.

However, in 2021, centralised exchanges are no longer completely operating in the wild west and, in the future, will likely come under greater regulatory oversight with a lower risk of loss of funds through insurance. Coinbase will soon be a listed US company and will have public records and regular audits to ensure everything is in order. Kucoin was able to recover the lost funds through insurance, and the users were eventually unaffected

Disproportionate Influence of Centralised Exchanges

Another core tenet for crypto assets is decentralisation and democratisation of power, and without it, BTC is no different from Libra or USDT. Having funds on custodial exchanges gives them ecosystem-defining power as tokens also get governance votes and allow holders to define the protocol’s direction. In May 2020, Binance was caught in the fork dilemma of STEEM token and flip-flopped on which party to support, having the deciding number of votes.

While it finally sided with the majority of the users, the fact that a centralised exchange has such power is already concerning. This is even more concerning for the future of competing protocols, as Binance is one of the largest holders of the DEXes tokens. Relying on the continued benevolence of a centralised exchange is against the ethos of the crypto world.

Democratising Fund Raising and Listing of Assets

With thousands of crypto assets to be excited about and choose from, the utility provided by a trustless exchange has never been more apparent. Whether it is the latest yield aggregator, NFT, oracle, or interoperability project, the first thing the investor wants to know is “when token?” wanting to be the first to invest in it. DEXes provide a solution without expensive listing requirements of centralised exchanges. Not only providing liquidity to a wide variety of coins, but DEXes also allow for new projects to raise funding through an Initial DEX Offering (IDO) where the project team opens a new pair for their token against ETH or a stable coin on a DEX becoming the first LP.

The open and vast pool of investors can then come in and collectively help in true price discovery. While we are all in it for the tech, the ability to make quick gains on the newest project does sustain that interest. Ten to hundreds of new currency pairs are opened on Uniswap every day.

With complete freedom and no checks on the team and product authenticity, many fly-by-night projects may be listed on DEXes to dupe investors. There was also a plague of projects being listed with names similar to highly anticipated projects. Uniswap has mitigated this by introducing verified lists of projects and various warnings to inform users if they are about to invest in an unverified product.

Censorship Resistance

Decentralised exchanges live as code on the smart contract. Anyone with access to a wallet can connect to the contract and transact with it without requiring any identification or background checks. There has been no regulation stopping individuals in any jurisdiction from trading on a DEX, and it is unlikely that even if one comes, it will be enforceable and will fully accomplish its goal.

For example, the Uniswap smart contract is deployed already and lives on the Ethereum blockchain and is not in control of any single entity. Even if the front-end is taken down, it is possible to interact directly with the blockchain contract.

Programmability

What makes the opportunity in decentralised finance (DeFi) exciting is that it is like a lego box with each protocol providing another opportunity to build on top of it. DeFi is a stack of interrelated contracts with each providing service to another. Liquidity tokens on decentralised exchanges can be used for yield farming (like yearn finance vaults for various curve pools) or staked for “reflexive yield farming”, i.e. raising funds by rewarding users who provide liquidity.

Centralised exchanges are also providing saving and staking products to compete with the yields provided by DeFi. However, the products are limited, and the yields are not as high.

Conclusion

The case for DEXes is the same as the case for bitcoin, being in charge of your funds. There will always be a need to move between assets and increase and decrease risk based on market conditions. Centralised exchanges currently provide this service. But decentralised exchanges will continue to grow as limitations like transaction cost, slippage, order books, margin trading, options and leveraged positions are addressed. There are already upcoming projects or improvements in current projects addressing one or more of these limitations.

It is only a matter of time that decentralised exchanges start controlling a higher share of volumes. Even centralised exchanges understand this and are already looking to diversify by offering decentralised solutions like Serum by FTX or Binance Smart Chain by Binance. However, the incumbents with an already established user base will likely capture most of the volumes as we advance.

*Originally posted at CVJ.CH