Technological innovations are now virtually the order of the day, and digitalization is not even stopping at our means of payment.

Crypto currencies on the advance

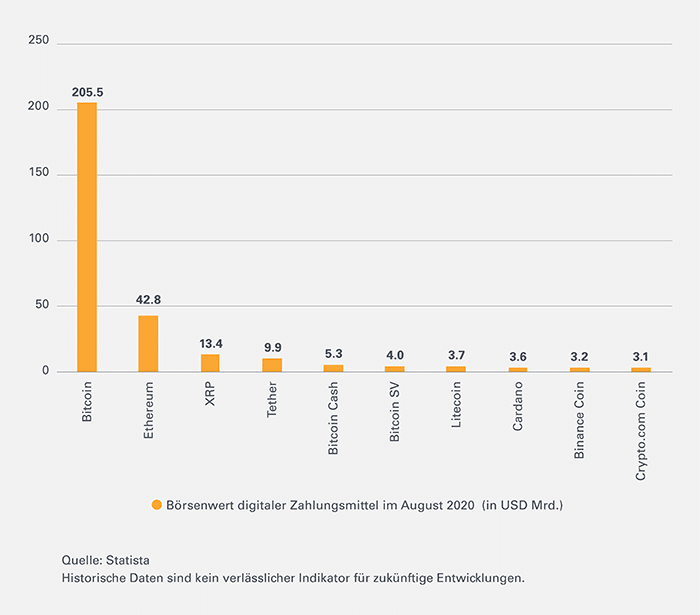

An incredible 6,510 crypto currencies with a total market capitalization of 309 billion EUR are currently in use around the globe according to CoinMarketCap. By far the most popular cyber currency is Bitcoin (BTC), developed by Satoshi Nakamoto in 2008. A total of EUR 183 billion is currently accounted for by the most important digital coin, representing 59% of the total volume of crypto currencies. That success is not a matter of course, however, is shown by a look at the already again “buried” exotic means of payment. According to the website Coinopsy, there are now 1,648 so-called “Dead Crypto Coins”, i.e. digital foreign currencies that already have disappeared from the market.

Means of payment of the future

In view of the high dominance of Bitcoin and its daily trading volume of more than EUR 20 billion, it is not surprising that this very crypto currency is traded in many places as a means of payment of the future. Also in things security leaves the Bitcoin no desires open. The Blockchain technology, with which each transaction is unmistakably summarized and cryptographically linked in a data block, makes the cyber currency safe from manipulation. As a result, acceptance among the population is also increasing. For example, anyone living at the foot of the Matterhorn in Zermatt in the canton of Valais has been able to pay local taxes and community fees with Bitcoin since the beginning of this year.

Up and down

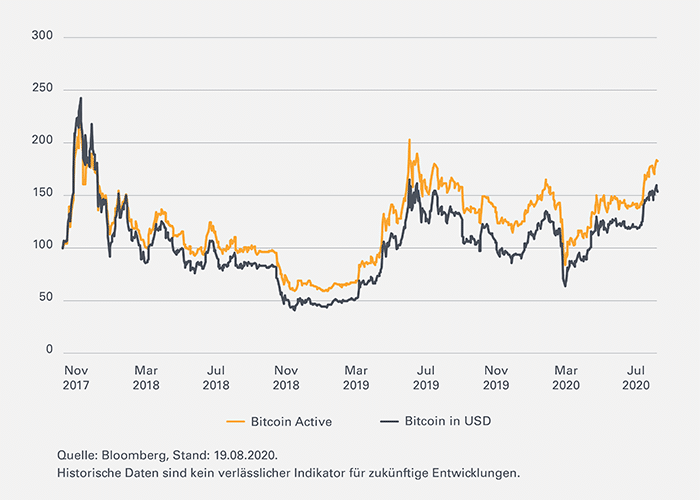

How many Bitcoins must be used for a transaction depends on the exchange rate. Like any other currency, the digital coin is subject to fluctuations, and these can be quite substantial. Here is a look at the past: if the digital currency broke the USD 20,000 mark at the end of 2017, investors only had to pay around USD 3,000 for a BTC one year later. But recently the curve has been pointing upwards again. At the beginning of August, Bitcoin reached USD 12,489, the highest level in 13 months. Experts see various reasons for the increase. The analysts at Emden Research, for example, blame part of the rise on a short squeeze, where short sellers have to cover themselves. But the declining confidence in the greenback could also play a role. In addition, the uncertainties surrounding COVID-19 and political crises around the world are causing more and more investors to use Bitcoin to diversify their portfolios.

Artificial scarcity

The so-called “Bitcoin Halving“, i.e. the deliberate shortage of BTC, could be another driver of development. Every four years, the reward for the computing power behind the digital currency is halved. Background: In total, there can only be 21 million Bitcoin, about 18.3 million have already been generated. The last such event occurred in May of this year. The experts at Coin-Ratgeber point out that the artificial shortage at the past events in 2012 and 2016 only occurred after about a year in each case. Experts therefore believe Bitcoin is capable of even more. Longforecast.com expects a further price increase for the rest of the year. This applies especially to the fourth quarter. The platform, which specializes in forecasts, expects to close in October at USD 14,120, and by the end of December the 15,000 mark could be passed. According to Longforecast.com, exchange rates of around USD 17,000 are even possible at the start of 2021.

Market capitalization of the top 10 crypto currencies

Actively managed strategy with proud track record

Lucrative view into the rear view mirror

When it comes to digitization, there is no getting around “machine learning”. This is a branch of artificial intelligence that generates knowledge from experience. Thus, on the basis of immense data amount, an attempt is made to recognize patterns and regularities with various algorithms. Swissquote Bank took advantage of this innovative technology around three years ago and developed the Swissquote Bitcoin Active Index. This is the first crypto-currency strategy listed on the stock exchange and has achieved significant outperformance to date. The matching tracker certificate (ISIN CH0372703436) from Leonteq outperformed a direct investment in Bitcoin by around 29% – even taking fees into account. In November the term of the index paper will now end.

New strategy with a tried and tested concept

But Bitcoin fans don’t have to worry, the winning strategy goes into extra time. Thus recently a follow-up product (ISN CH0542378622) was launched on the Swissquote Bitcoin Active 2.0 Index. With this tranche, a fixed expiration was waived and an open-end structure was chosen instead so that no more portfolio reallocations are necessary in the future. As already mentioned at the beginning, the structured product is backed by a machine learning-based strategy. Data from various sources are collected to form quality indicators. These consist of an average value of changes, the volatility achieved the buying and selling pressure, and a social index for market sentiment. The algorithm compiles and interprets this wealth of data, identifies the short-term development of future returns, and then structures the portfolio based on this extensive analysis. To limit volatility, the portfolio is composed of a minimum of 60% and a maximum of 100% Bitcoin and a maximum of 40% and a minimum of 0% US dollars.

Active management at an affordable price

The tracker certificate offered by Leonteq participates in the Swissquote Bitcoin Active 2.0 Index. The product, which is listed in US dollars, was launched on 27 July 2020 at a price of 1,000. Since then, the price has risen by more than a fifth. Since it is an actively managed certificate, fees are incurred. These fees consist of calculation costs of 0.35% p.a. and a management fee of 1.00% p.a. In addition, there is a rebalancing fee of a small 0.15% p.a., so that in the end the total charge for the certificate holder does not exceed 1.5% p.a.

A certificate with clear advantages

Even if in the meantime with many investors a reorientation took place with the purchase of crypto currencies, the trade, as well as the possession, is not absolutely risk-free. Besides the partly high fluctuations in the BTC, hacker attacks can also pose problems. Attacks on the Bitcoin Blockchain are relatively unlikely since it is constantly being verified. Persons and websites, on the other hand, are certainly in the sights of cybercriminals. For example, the popular crypto stock exchange Mt.Gox was hacked in 2013, which meant the loss of 800,000 BTC. The so-called wallets, which are used to store crypto currencies, are also often the target of Internet thieves. In contrast, the tracker certificate on the Swissquote Bitcoin Active 2.0 Index offers easy and protected access to Bitcoin. As usual, the security is safely stored in your safekeeping account.

Chart comparison: Swissquote Bitcoin Active Index vs. Bitcoin