The Bitcoin price has fallen sharply in recent months in response to the COVID-19 pandemic, but this has not reduced public interest in crypto-currencies. Some of the US government’s helicopter money is also being used to buy Bitcoin.

As Forbes magazine reports, several Americans are using the $1,200 stimulus checks to purchase crypto-currencies such as Bitcoin. A high volatility of the Bitcoin price usually attracts investors as well. According to the report, crypto exchanges have seen increased account and trading activity after the price fall in March, with crypto exchanges specializing in derivatives in particular — posting record volumes.

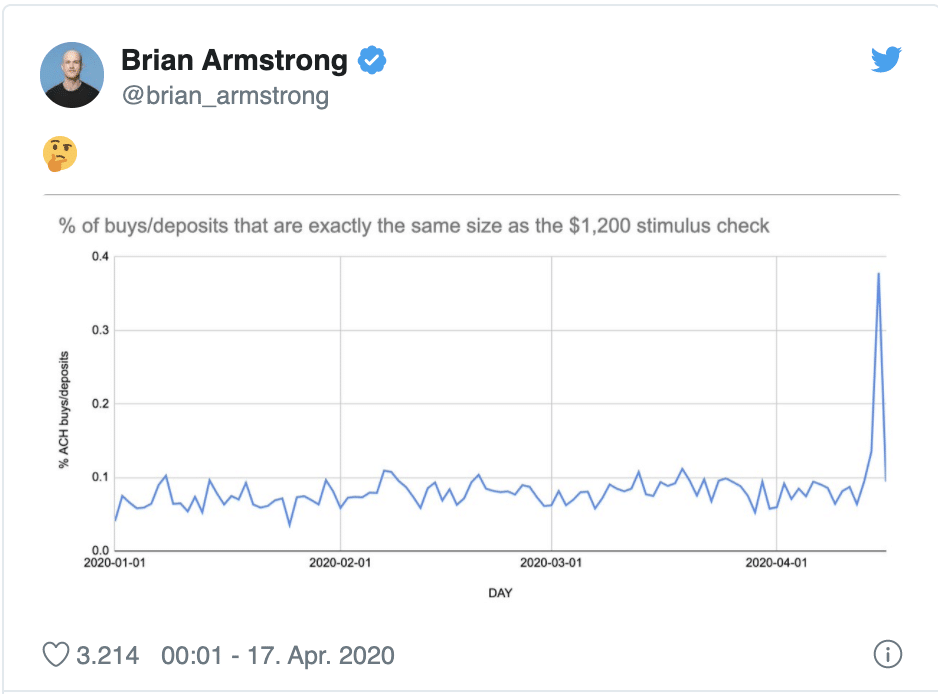

Number of transactions with a volume of 1,200 dollars increases

During the current turmoil in the economy and the upcoming Bitcoin halving, the first user voices claiming to invest the money from the CARES act in Bitcoin have already appeared in many forums. The CEO of Coinbase, Brian Armstrong, had documented this in a tweet with a diagram. According to the chart, several deposits and transactions were made with a volume of exactly $1,200.

The use of the stimulus cheques to buy Bitcoin could be interpreted as a protest against the devaluation of Fiat money. The process of fiat currency devaluation is further accelerated by the increasing amount of money put into circulation by the central banks through newly printed money. The investment of helicopter money in Bitcoin can therefore be interpreted as an opportunistic investment decision or as a protest against the current state of the global financial system. In this case, an inflationary currency would be exchanged for a deflationary one.

Helicopter money generates increased Bitcoin Google search queries

It is undisputed that the current actions of the central banks, especially the Federal Reserve, are increasingly shifting interest back towards non-inflationary assets. Thus, in addition to the rise in the price of gold, renewed global search interest for the crypto-currency Bitcoin on Google was also noted.

Bitcoin enthusiasts were first excited about an initial (random) correlation of Bitcoin to gold in 2019. There was already talk of the new digital gold, which would soon replace the old metal as “Save Haven”. But in line with the traditional financial markets, Bitcoin lost 30% within a very short time. This circumstance was not least due to the high leverage with which stock exchanges speculate on derivatives.

COVID-19 Economic stimulus package using the digital dollar

The US government had recently considered making the payments of the Covid-19 stimulus package in the form of a digital dollar. Digital wallets should be used for this purpose, making it quick and easy to pay out emergency funds to consumers. Even if the recipient does not have a bank account, it should be possible to send the money to the recipient quickly and easily.

*Originally published in German at CVJ.ch