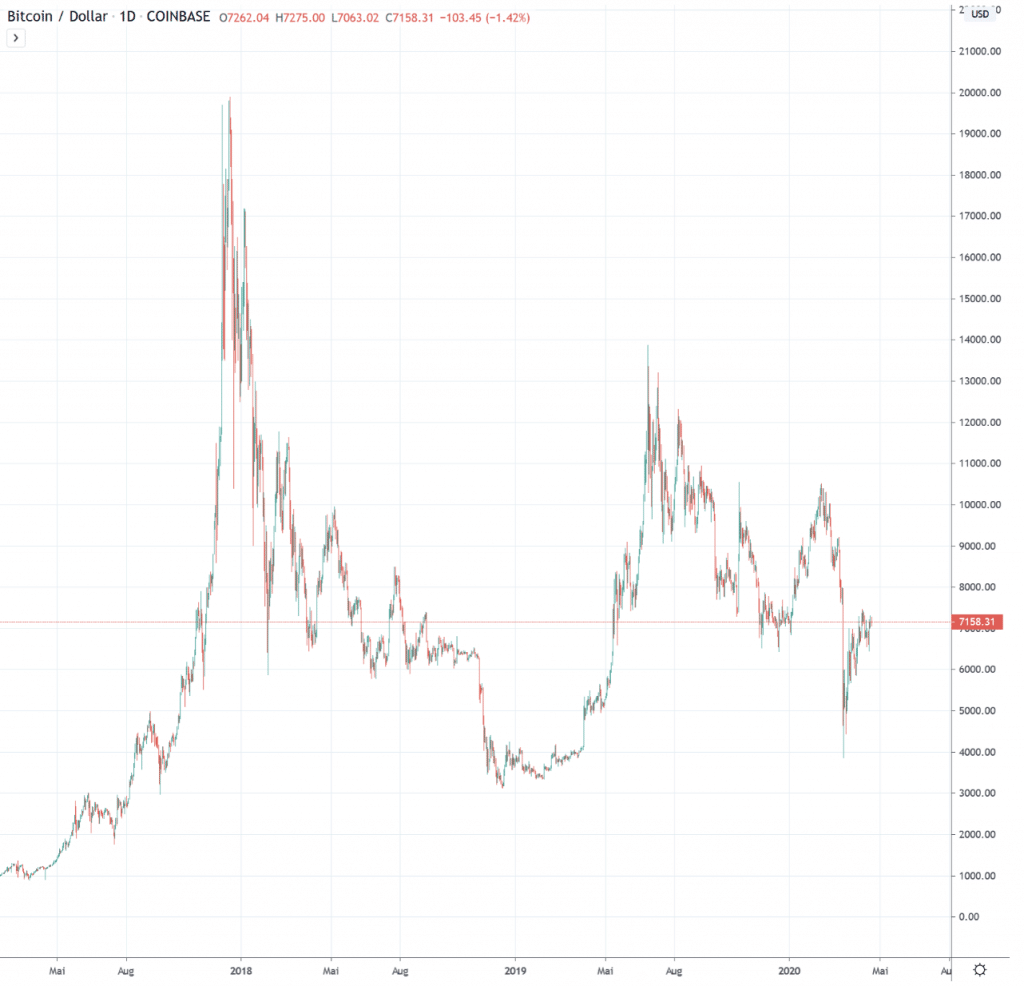

Bitcoin/USD daily basis

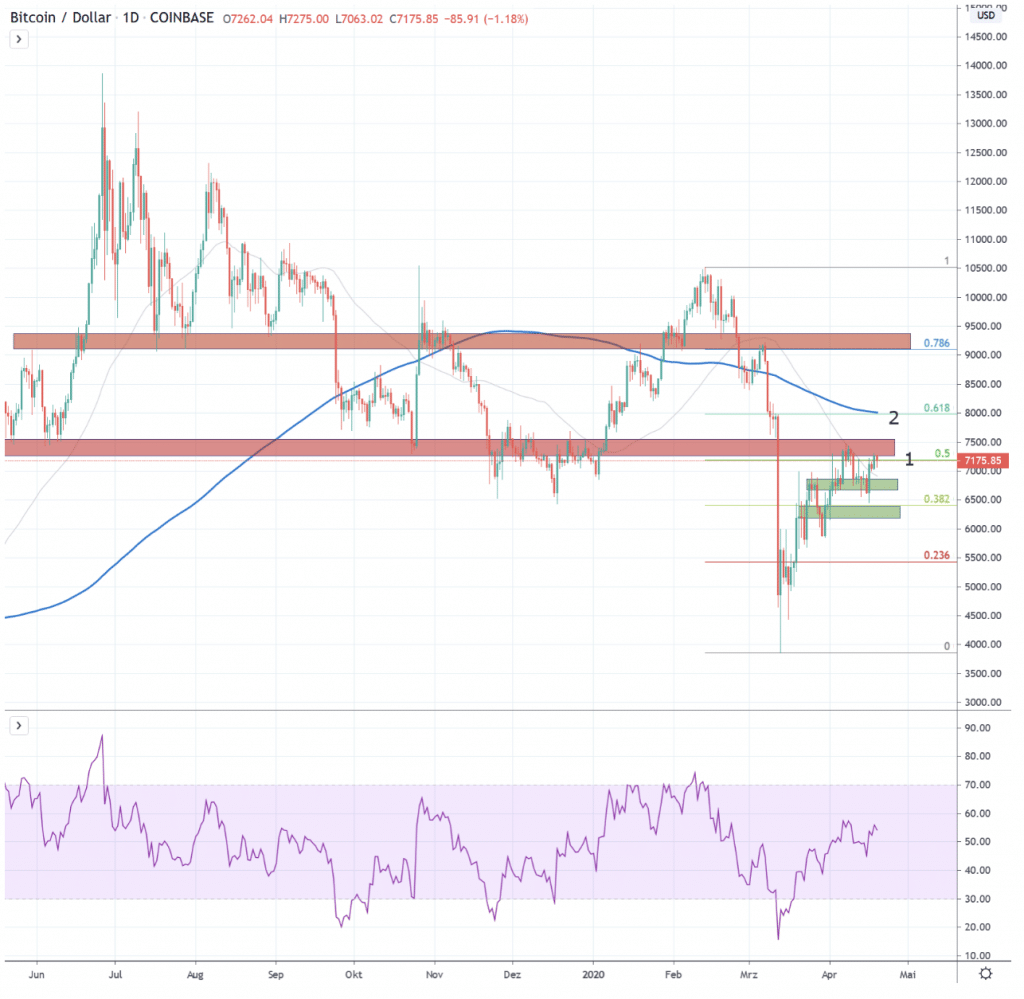

Bitcoin USD – Range between 6’500 and 7’000 USD

The Bitcoin price tested the zone below USD 7,000 at the beginning of the reporting week. Already on Monday there was a downward movement to just under USD 6,500. However, the price recovered to over USD 6,800 on the same day. On Wednesday the next detour to 6,500 USD took place and on Thursday another attempt to bring the price below 6,500 USD was clearly rejected. As a consequence, higher daily lows and highs followed over the next 3 trading days, which in turn brought the price above the USD 7,000 mark. On the weekend, a renewed consolidation around the USD 7,000 mark took place, in a range of USD 300.

Resistance zone above 7’000 USD remains a hurdle in the micro-trend

Bitcoin managed to form a pattern of higher lows in the micro-trend after its fall about four weeks ago. This countermovement now ended for the second time in the resistance zone, which was formed by price movements between November and January 2019, as well as by earlier supports (red).

Hence, a “normal” countermovement after the price drop is still to be expected. Although it was able to continue to build on its foundation of higher lows, it has failed to break above the USD 7,000 mark for the time being. From a Fibonacci perspective, we are just above the 0.5 point of the correction since the high in February (1).

In the current structure, the course may soon be set in the micro-trend. If the USD 7,000 mark can be breached on a sustained basis, interesting resistance zones will follow. First, there is the USD 8,000 mark, where the 0.618 Fibonacci point and the 200-day average are located (2). This is followed by a strong resistance zone starting at USD 9,000, which was created by earlier supports.

In order not to weaken the new positive structure, the newly created supports at 6’700 and around 6’300 USD should be respected. A drift below USD 5’900 would have to be seen as a capitulation of the young upward movement and increases the probability of a renewed visit to the USD 5200 – 5’000 zone. Consequently, a renewed testing of the USD 3,000 – 4,000 spheres would have to be attributed an increased probability

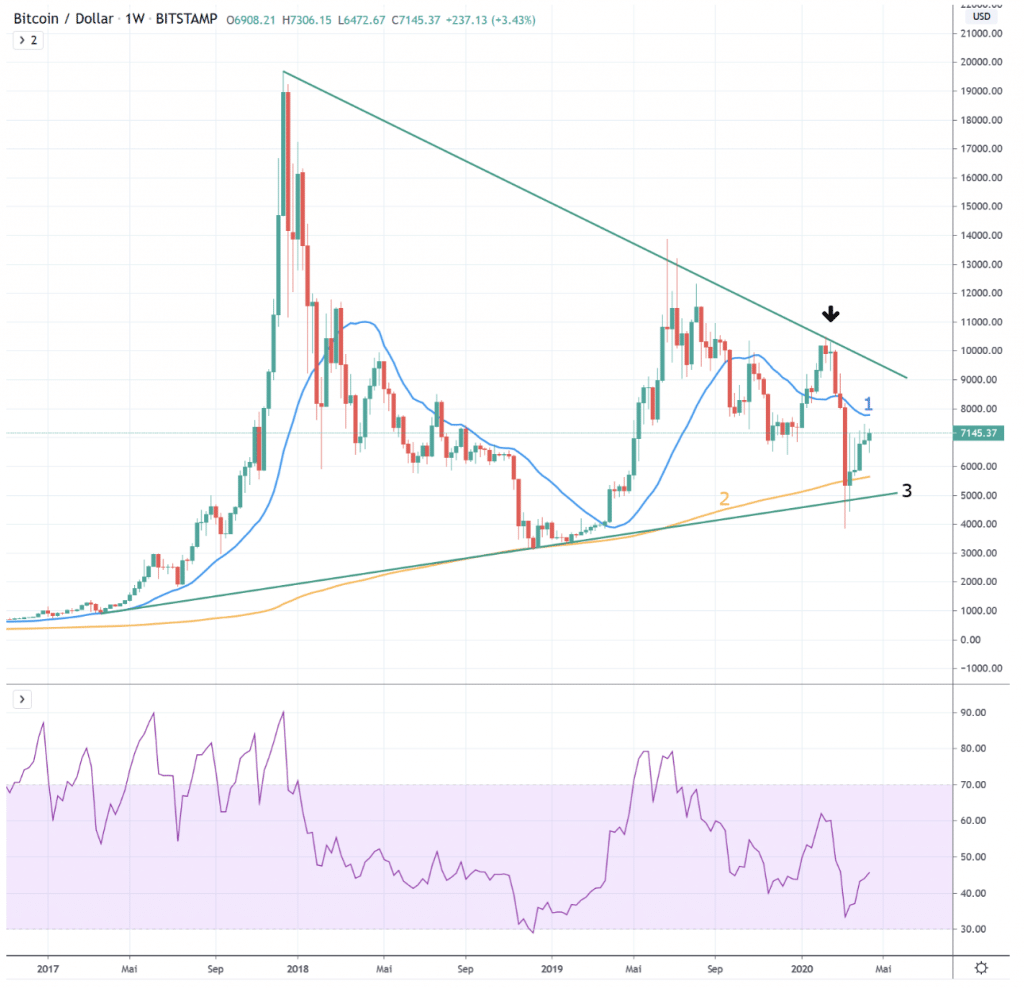

Macro: Chronology of lower highs since the end of 2017

Bitcoin has so far failed to set a higher high in the weekly interval, which would have broken the prevailing bearish trend since December 2017. In its last attempt since the beginning of the year, the upward trend in the relevant zone at around USD 10,500 failed to establish itself. The sharp price correction in mid-March is further confirmation of the prevailing downtrend.

Bitcoin is now clearly below the 21-week average (1), which in the past often decided about bull markets or bear markets. The 200-week average (2), which has never been broken since its inception, and the trend line (3) of the lower bandwidth of the uptrend since March 2017 are also being tested. They will serve as further indications of how distressed Bitcoin is at present.

The macro picture remains dominated by lower highs since December 2017 in the downtrend. Bitcoin must create a new basis for itself. If the USD 5,000 mark does not hold, between USD 3,000 and USD 3,500 support is expected from the bottoming out of early 2018.

The negative macro picture can only be broken in the medium term if the trend of lower highs since 2017 is sustainably overcome.

Disclaimer

All information in this publication is for general information purposes only. The information provided in this publication does not constitute investment advice and is not intended as such. This publication does not constitute an offer, recommendation or solicitation for an investment in any financial instrument including crypto currencies and the like and is not intended as an offer, recommendation or solicitation. The contents contained in the publication represent the personal opinion of the respective authors and are not suitable or intended as a basis for a decision.

Notice of risk

Investments and investments, especially in crypto-currencies, are generally associated with risk. The total loss of the invested capital cannot be excluded. Crypto-currencies are very volatile and can therefore be exposed to extreme exchange rate fluctuations within a short period of time.

*Originally published in German at CVJ.ch