Without a doubt, Decentralized Finance (DeFi) was a strong driver of crypto markets in 2020. Bitcoin (BTC) did rise over 300% and Ethereum (ETH) over 480%, but some of the DeFi tokens outperformed those gains with monumental price increases.

Many of today’s DeFi-related coins did not exist at the beginning of the year as the scene has resembled a microcosmic explosion of new protocols and tokens all within a six-month period. Many of those tokens have resembled the pump and dump patterns that 2017’s altcoins went through, but some have performed solidly, and this article will highlight those high flying assets.

Early days of DeFi

There were not many DeFi-related tokens trading at the beginning of 2020, just a fraction of what had flooded the markets by the end of the year. Every new protocol needed its own governance token and they were mined like crazy by “degenerate farmers,” or degens as they became known, seeking a quick buck. Naturally, the whales and insiders got considerably richer off this farming frenzy while the smaller retail traders seeking short-term gains generally got burnt fingers. Investing in a new project just hours too late often resulted in a painful exit as those insiders made off with the loot, dumping the newly distributed tokens back onto the market.

Anyway, back to the beginning of 2020, and the leading token and platform for the industry was Maker’s MKR priced at $440 during the first week of the year. Also in the top 100 crypto assets was Synthetix’s SNX which was trading for $1.13. If Chainlink (LINK) is to be considered a DeFi token, it was priced at $1.81, at the time. The 0x Protocol token, ZRX, was trading at around $0.187, at the time, and Augur’s REP was priced at $9.46. Kyber Network’s KNC was outside the top 100 trading at $0.21, as was Bitcoin wrapping protocol token REN at $0.035. Loopring’s LRC was at $0.022, while Aave’s LEND token was changing hands for just $0.016.

Outside the top 200 were Bancor’s BNT, Gnosis’ GNO, THORChain’s RUNE, and KAVA. This pretty much sums up the major DeFi-related tokens, at the beginning of the year. Way off the radar in the low cap divisions was Melon Protocol’s MLN token, which was trading for around $2.90, at the time. Prices for the beginning of 2020 have been taken from Coinmarketcap’s historical snapshot for the first week in January.

Long-term gainers

From those that were around at the beginning of the year, a few have made impressive gains. Maker ended up as the top DeFi protocol in terms of total value locked which was around $2.6 billion by mid-December, but its MKR token price gains left a lot to be desired with just 22% added. SNX did much better over the year netting a 360% gain to top $5.20 by mid-December, while LINK was on fire in 2020 gaining over 650%, over the year. ZRX doubled in price, REP made 70%, KNC cranked 330%, but REN topped them all with a 725% gain ending in mid-December at around $0.30.

Loopring also had an epic year, with a gain of 670% to reach $0.17, and Aave’s LEND token was rebalanced and rebranded to AAVE with the supply reduced by 100 times, so the relative price gain would have worked out at around a ridiculous 5,000%, as it topped $85 by mid-December. Bancor’s BNT token had a solid year gaining 670%, while Gnosis’ GNO made 470%, and Melon, which has recently rebranded to Enzyme Finance, has trounced them all with over 960% added over the twelve months for MLN.

New kids on the DeFi block

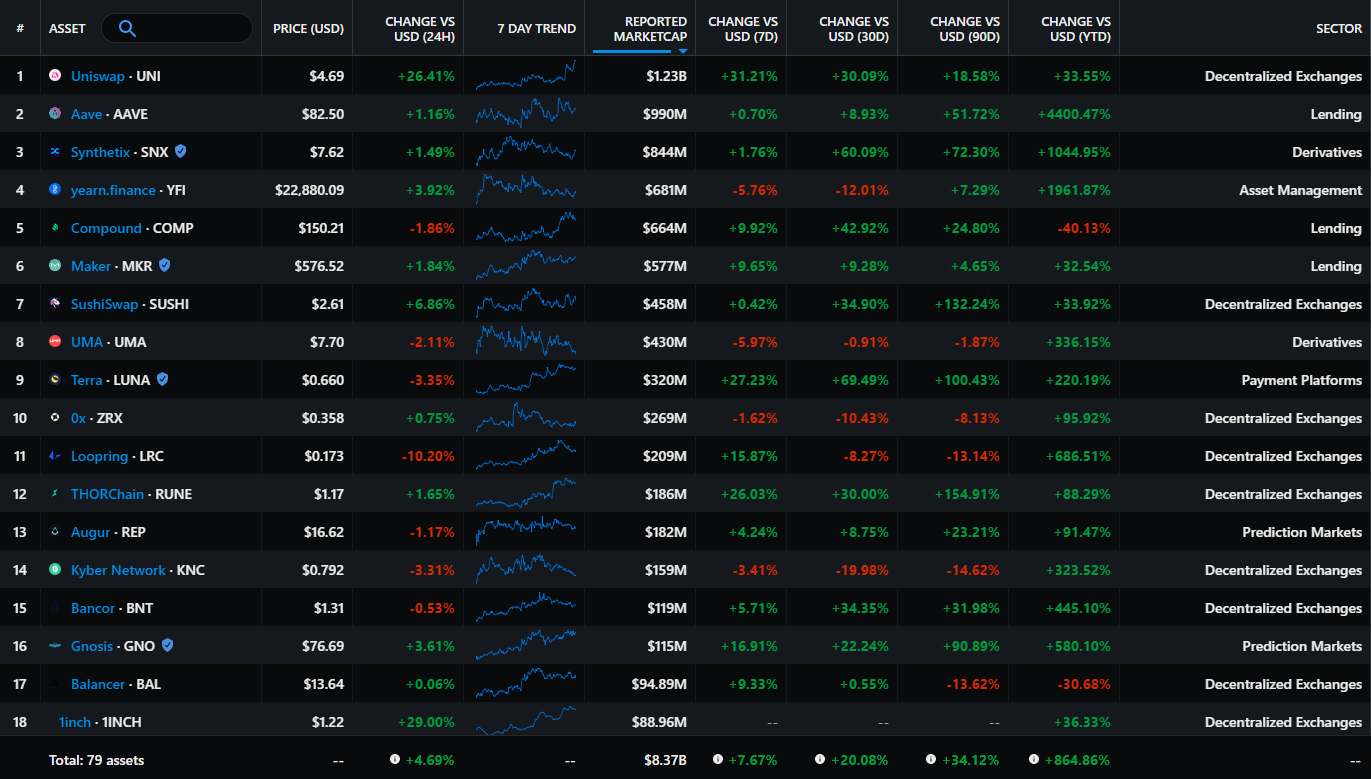

The majority of DeFi tokens were spawned between August and October, and the majority of those have exhibited pump and dump patterns remnant of the 2017 — 2018 altcoin and initial coin offering (ICO) boom and bust cycle. Some have performed better than others, however, and the Messari DeFi Returns Index is a good resource to compare them.

Yearn Finance has been one of the most innovative and influential DeFi platforms of the year by introducing a way to simplify and automate yield farming with its strategies and vaults. According to the Messari index, its native YFI governance token has made around 2,350% by mid-December. From a basically zero value token, YFI surged to a ridiculous bitcoin beating price of $44,000 in mid-September driven by pure FOMO and the perception of a very limited supply. By mid-December, YFI was still trading higher than BTC at around $26,500.

There were a number of other newcomers that made a big impact at the time driven by degen FOMO, but have fallen back since. Some of the survivors include UMA, which traded at around $1.50 in May and June before surging to $25 in early September and retreating to $9 in December. Cover Protocol is another newly launched DeFi insurance-based token that has made big moves with a 260% gain from launch price to current prices. A slew of dodgy food farming themed tokens sprung up in the latter half of 2020, but as we’ll see below, the majority of them wilted soon after they had fruited.

DeFi pumps and dumps

Not all DeFi tokens have made gains, and many of them are still languishing way below their peaks and pumps that occurred when the protocol was launched. SushiSwap’s SUSHI governance token is probably the best-known one as it surged to almost $9 after the protocol was launched in early September. Prices then crashed a few days later, when the founder known as Chef Nomi sold his stash and the token ended up 95% down from ATH two months later. In mid-December, SUSHI was still 70% off its peak, trading at $2.80.

In mid-December, Yam Finance’s YAM v2 token was down 87% from its giddy height of almost $50 in early September. Curve Finance has been another pump and dump type token, as it too surged to $1.60 when the protocol launched and dumped soon after. At the time of writing, CRV was trading for $0.64, down 60% from its all-time high. Swerve Finance has shown a similar pattern with a pump to $7 in a FOMO driven product launch, then a 90% dump to the prices around $0.7. It’s the same story for Pickle Finance, which powered to over $55 before sliding over 70% to below $15 in mid-December.

Yield farming pioneer Compound Finance has also seen its governance token drop over 50% from its initial pump of over $300. Uniswap’s new governance token UNI cranked to $7, just after the big airdrop but has since retreated around 45%. Other depressed DeFi tokens include YFII, ADEL, BAL, MTA, SRM, APY, BZRX, and CREAM.

Concluding the top DeFi performers of 2020

Aave’s token of the same name takes the gold medal for best performing DeFi asset of 2020, with a monumental gain of around 5,000%. This is taking into consideration the token supply reduction and migration, as the original LEND token was trading for around $0.016, at the beginning of the year. Yearn Finance’s YFI takes silver in terms of gains, with an eye-watering 2,350% year to date and an all-time high of $44,000, less than two months after it was launched.

Decentralized on-chain asset management protocol Melon, which is now called Enzyme Finance, comes in with bronze, according to Messari, notching up an impressive 960% gain, over the year, for its native MLN token, which had reached $32 by mid-December. In the 500% plus group are Chainlink’s LINK, wrapped Bitcoin protocol token REN, Layer 2 DEX Loopring’s LRC, Bancor’s native token BNT, and GNO from Gnosis.

DeFi’s ups and downs

As we have seen, not all DeFi tokens have golden linings, and the mass explosion of them from August to October overwhelmed markets with largely useless governance tokens for duplicates of clones of other protocols with their own tokens.

It was literally a token fest, as degen farmers jumped from liquidity pool to liquidity pool to load up on these governance token distributions. They then proceed to sell them as soon as they could, totally negating the concept of the protocol.

The entire scene has been very similar to the altcoin bubble three years ago when everything had to have a blockchain and a token whether it needed it or not. As we have seen since then, only the fittest will survive in this fast-paced world of decentralized finance.

*Originally posted CVJ.CH