The Swiss Stock Exchange welcomes ETC Group as a new ETP issuer. With the listing of the BTCetc Bitcoin ETP (Primary Ticker: BTCE) by ETC Group, the Swiss Stock Exchange is strengthening its position as world leading marketplace for regulated crypto products.

We welcome ETC Group to the family of ETP providers offering their products at SIX. With the new product, investors gain access to 100 different crypto products trading on our platform and with this have even more opportunities to diversify their portfolio.

Christian Reuss, Head SIX Swiss Exchange, Markets, SIX

The Swiss Stock Exchange, the world’s leading marketplace for regulated crypto products, has registered a break of the billion barrier in trading turnover in crypto products for the first time with CHF 1.1 billion in 2020, which surpassed the record CHF 525 million from 2017 by 112%; the number of trades reached a new record of 48,024. ETC Group lists a Bitcoin ETP, taking the number of ETP providers to six and the number of ETPs to 34 – further strengthening the position of the Swiss Stock Exchange as the world’s leading marketplace for regulated crypto products.

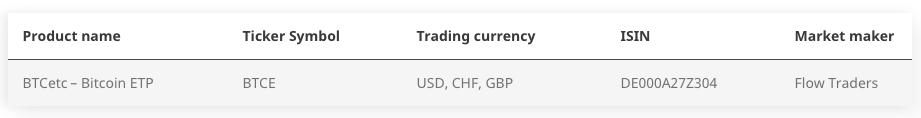

BTCetc – Bitcoin ETP

The newly listed product BTCE tracks the price of Bitcoin and is 100% physically backed, providing investors with a transparent way to gain exposure to Bitcoin. Each unit of BTCE gives the holder a claim on a predefined amount of Bitcoin. ETC Group is specialized in developing innovative digital asset-backed securities and is backed by a number of major London-based financial institutions. Shareholders include XTX Ventures, the venture capital arm of electronic market-making firm XTX Markets, and financial services firm ITI Capital, which also acts as Authorised Participant for BTCE. BTCE is issued by ETC Group and marketed and distributed by HANetf, an independent provider of UCITS ETFs, working with asset management companies to bring differentiated, modern and innovative exposures via their white-label platform to European investors.

*Originally posted at CVJ.CH