In crises, the flight of investors often leads to the safe haven of “cash”. Most other asset classes are affected by this. Crypto also experienced a fall in prices during the Corona crisis. In the medium term, the portfolio diversification effect will predominate.

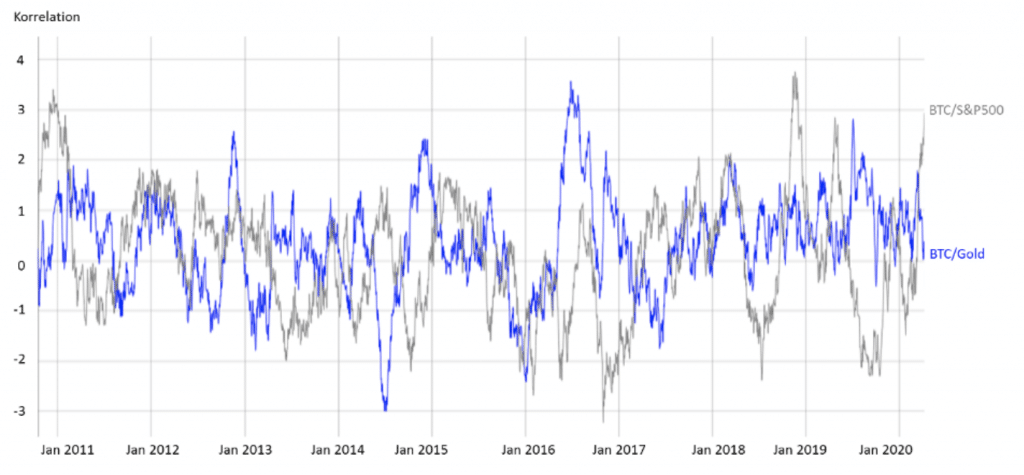

In the medium term, however, the high independent component (alpha) of Krypto leads to a low correlation with other asset classes. Alpha and beta are two important measures in portfolio theory and can also be applied to crypto. The alpha measures the project-specific return and the beta measures the market-specific return. Crypto’s show a high beta in the short term. However, due to the high alpha, there is hardly any correlation to other asset classes in the longer term (Chart 1).

Short-term “risk off” for all asset classes

In shock-like crises, the correlation is particularly high for the time being, because investors prefer the safe and familiar port of “cash” due to the uncertainty and reject all other asset classes. Margin calls reinforce this trend. Only gradually does the dispersion of returns begin. This was also the case during the Corona crisis (Chart 2). Since the beginning of the year, the S&P500 has posted a loss of -14.8%, while Bitcoin is trading in the black despite a short-term price drop.

Bitcoin is by far the largest crypto token with a 60% share of market capitalization. In addition, there is a whole range of other tokens, also called Altcoins (Alternative Coins). These are newer, more recent projects and business models that are slowly moving up from the back rows. Altcoins can further improve the risk/return profile of a portfolio. However, since these projects are start-ups, good selection is essential. We assume that up to 80% of the projects will disappear over time.

Altcoins as salt in the soup of portfolio diversification

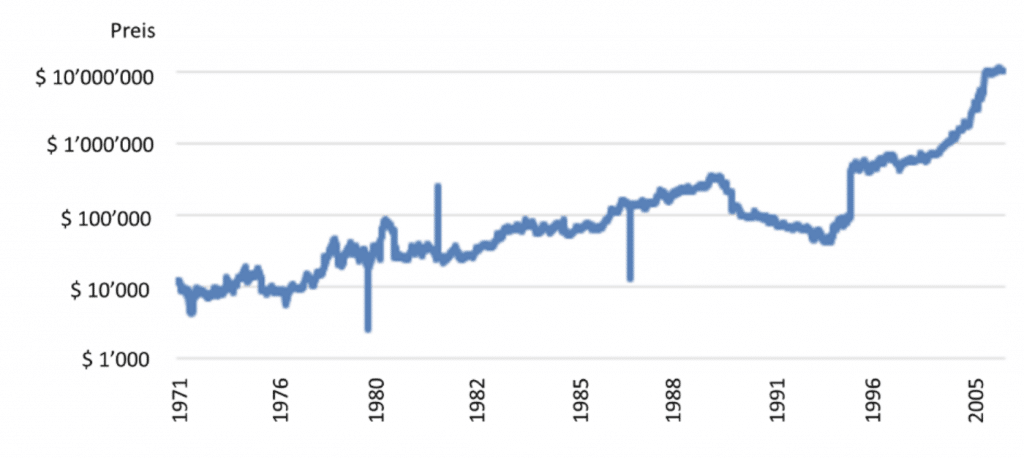

Altcoins are mainly crypto-currencies that provide access to an ecosystem. These include smart contract platforms such as Ethereum and decentralized applications based on them. Increasingly, strong external partners such as Google, Amazon and Microsoft are also being involved in the projects. Crypto-currencies of stock exchanges are also interesting, as the owners pay lower trading fees. A limited number of tokens leads to scarcity. The concept is similar to the former stock exchange ring. Since the seats were limited, the price for a front row seat on the Nymex (Future Exchange for Oil Trading) rose from $10’000 to $10’000’000 between 1971 and 2008 (Chart 3).

Conclusion: Crypto did not prove to be a safe haven in the short term during the Corona crisis. In the medium term, however, there is no correlation to traditional investments such as gold or equities. The art is to identify high-quality crypto projects and integrate them into the portfolio. This combination of low correlation and high alpha can significantly improve the risk-return profile of a portfolio.

*Originally published in German at CVJ.ch