An insatiable thirst for dollars, the race for the status of the global reserve currency and interest rates on the block chain. Many changes are underway in the structure of the global economy. Currencies, exchange rates and interest rates seem to be shaped by digitalization.

We have seen an explosion in the demand for Stablecoins in the cryptosphere, when at the same time the demand for dollars went through the roof. We thought it would be interesting to share some of our perspectives in the following extract.

In this paper we will cover the following:

- The insatiable thirst for dollars…

- The political significance around the digital currencies of central banks, also known as CBDCs

- The IMF’s SDR instrument as a potential global reserve currency

- The planned move away from LIBOR (London Interbank Offered Rate) and the general malaise about zero and negative overnight interest rates in the banking and financial landscape

Insatiable demand for dollar and crypto as Eurodollar

We have long believed that the dollar is the lifeblood of the crypto-currency ecosystem, just as it is currently the lifeblood of all markets around the world. The dollar is virtually the global reserve currency. Eurodollars are dollar deposits held in foreign banks. The credit premium that the banks charge you for obtaining, buying and holding these dollars is effectively matched against LIBOR.

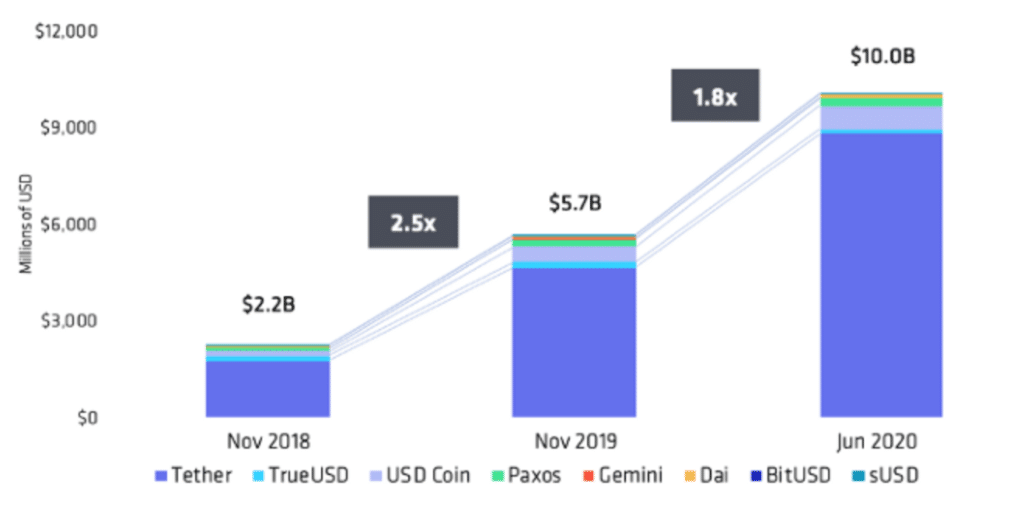

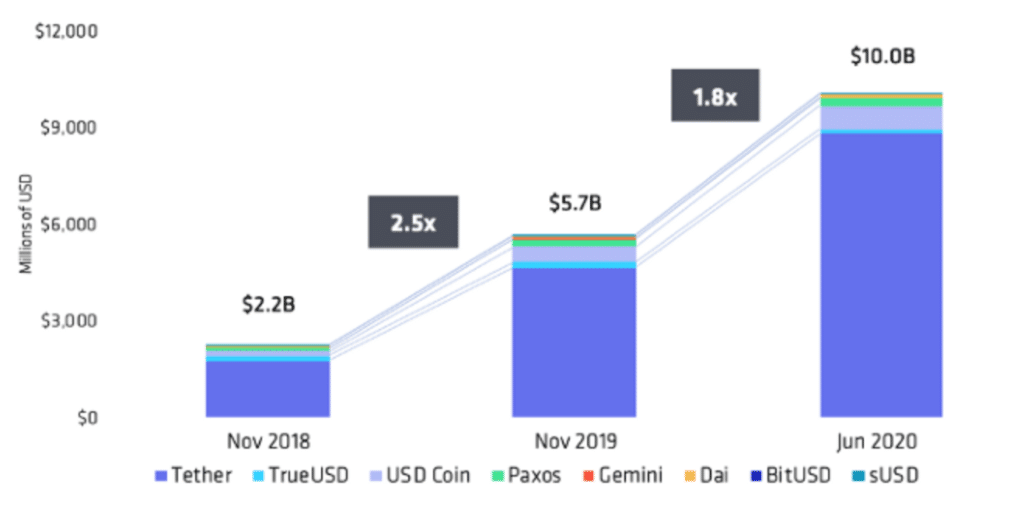

If crypto-covered Stablecoins with dollar pegging are to be the new Eurodollars, then these instruments also require LIBOR. Because if we look at the use of Stablecoins, one trend is very clear: it looks like the demand for dollars is not only a trend in the old financing, but also in the new area of crypto-financing. Although the crypto market in November 2018 was still as large as it was almost two years ago, the market for Stablecoins has grown almost fivefold over the same period. It would not surprise us at all if the value of Stablecoins were to exceed that of digital currencies in the very near future.

Dollars on a blockchain (whether secured by dollars in a bank account or by other digital assets and crypto currencies) are incredibly useful for creating a synthetic dollar link in a world where actual dollars are scarce, expensive and politicized.

The growing popularity of Stablecoins

One of the key issues we are addressing is the use of crypto-covered dollar-linked stablecoins as a way to extend correspondent banking, payments and investment opportunities to global markets. In a sense, this is a natural extension of the eurodollar market. In a world of zero or negative interest rates, the attractiveness of a digitally generated, highly portable and fungible dollar equivalent is not so difficult to imagine.

Although the market is still small compared to the global Eurodollar market, the rapid growth and spread of stablecoins has opened the eyes of central banks and the commercial banks that rely on them as a source of liquidity. Just look at the continued dominance of tether, a stablecoin linked to the US dollar. Tether currently has a market capitalization of over $8 billion and generates at least $200 million in fees per year. Tether is probably the most important asset in the functioning of the digital monetary ecosystem.

Why CBDCs are the antithesis of the crypto-currencies

In recent weeks, there have been several hearings in the United States Congress on the prospects of creating a digital dollar, perhaps even one “on a block chain” (whatever that means, honestly, we are not sure about it ourselves). The Chinese DCEP project has made significant progress and last week Xi Jinping stated that the digital renminbi would eventually be compatible with other public block chain assets. There is great confusion about what CBDCs are and how they would work. One of the common assertions is that CBDCs are “just like” crypto-currencies, except that they operate under legal and regulatory oversight.

In fact, CBDCs are the opposite of crypto-currencies like Bitcoin.

Bitcoin is an attempt to separate government and money — CBDCs are money owned by the state and managed by the state for the benefit of the state.

For example, China’s digital renminbi will create a single digital payment system, supported by the majority of commercial banks and the central bank, which may have the side-effect of minimizing the USD shadow economy, collecting data on payment flows and introducing more effective controls. This could involve the levying of taxes on these flows, which in the past took place outside the system in order to limit daily transactions between wallets or perhaps even to prevent certain individuals from using the digital payment system.

This does not necessarily require a digital currency or a block chain – India, for example, has withdrawn high value banknotes from circulation in 2016 to “curb the black economy and reduce the use of illegal and counterfeit cash”. The prohibition of higher-value banknotes was coupled with a digital payment and identity system, and efforts to discourage currency devaluation should encourage the adoption of these systems.

Once again, China has already introduced a financial surveillance system without the use of a block chain, but by digitizing the renminbi, they can also start exporting their surveillance not only to Chinese citizens, but to all participants who will use the digital RMB system in the coming years. Surveillance capitalism is not just for business – anyone can play!

A basket of currencies known as SDR: Special Drawing Rights and why they are interesting for CDBCs

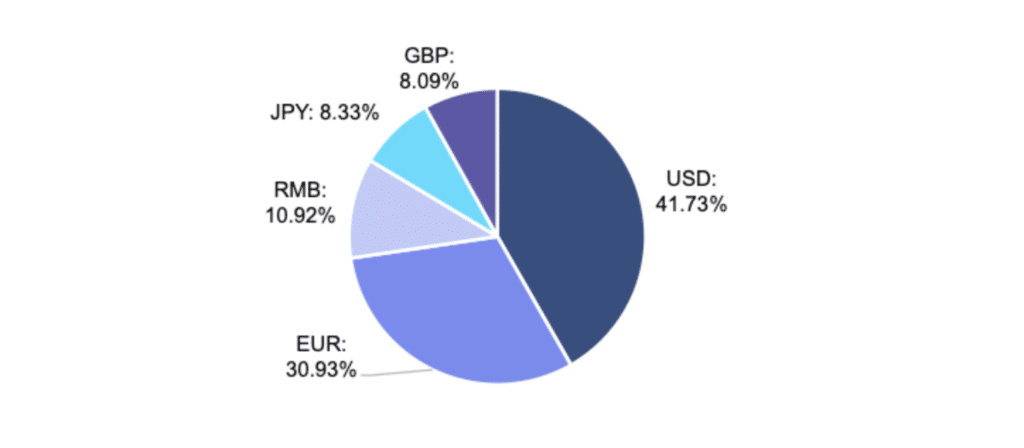

Special drawing rights, or SDR, is an international reserve asset created by the IMF. The value of the SDR is based on a basket of five currencies – the US dollar, the euro, the Chinese renminbi, the Japanese yen and the British pound.

How an SDR is made

It is now important to note that SDRs were created as additional international reserve assets under the Bretton Woods fixed exchange rate regime. The collapse of the Bretton Woods system in 1973 and the conversion of the major currencies to a system of flexible exchange rates reduced dependence on the SDR as a global reserve asset. In fact, the rise of the petrodollar following the 1973 oil embargo led to the rise of the US dollar as a global reserve currency and since then the SDR has receded into the background in many ways. (see this video about petrodollars)

But now the SDRs are back in the spotlight! In response to the recent coronavirus crisis, the IMF proposed in April to spend 500 billion dollars in new SDRs. The USA, which has a veto right in IMF matters, blocked the issue. So in a world where everyone wants and needs those sweet, sweet dollars, only 14 countries can currently access the Fed’s swap lines and tap into the global dollar supply. Other countries are on their own, especially the emerging markets, which are disproportionately affected by the effects of the coronavirus and their heavily dollarized economies.

One thing that many people don’t appreciate about SDR is that it has its own interest rate, the SDRi. The SDRi is the interest paid to members on their SDR holdings and charged on their SDR allocation. Unlike LIBOR or other daily or real-time interest rates, the SDRi is determined weekly based on a weighted average of representative interest rates for short-term government debt in the money markets. A proposal currently underway is to make the IMF a bank for SDRs, whereby it would borrow SDRs from developed economies and lend them to emerging markets that need them. In this way, SDRi could have the potential to become a global reference interest rate.

One development that we have been following for several years is the IMF’s keen interest in digital currencies. It does not take too many intellectual leaps to realize that SDRi is well suited to digitization, especially since the currencies of which it is composed could themselves become increasingly digitized and interconnected. If we look at Facebook’s Libra and its original proposal to create a basket of global currencies, this was indeed one form of this SDR approach. The SDR story is just beginning to unfold, but we bet that the IMF will be a strong candidate in the race for the global reserve currency.

LIBOR, Ameribor and interest rate setting mechanisms

Finally, we come to the interest rates. Although we know that LIBOR will expire from December next year, for the sake of simplicity we should stick to LIBOR in this analysis. In the past, LIBOR has set the price at which banks lend to each other. The interest rate was set by a small group of large banks and, as is well known, it has been subject to manipulation and fraud. LIBOR is a base rate that influences the pricing of many, many other types of financing arrangements. In the past, cryptoeconomics has lacked any kind of formal interest rate. The emergence of a credit market in the crypto-economy has created informal interest rates, but there is not a single standardized overnight rate that defines the industry.

One of the interesting things that we have dealt with throughout our business, but especially on the capital market side of our trading department, is the importance of overnight rates. In fact, crypto needs LIBOR if it is to be a currency substitute and if we intend for individuals, companies and nation states to keep it on their balance sheets.

In recent months, we have seen a number of innovative new approaches to interest rate setting in both the old financial markets and the crypto markets. To rely on a group of private banks to quote an interest rate is almost archaic, especially when we have technology that allows us to produce a real-time rate that can be broadly set by the market. The way in which prices are set is no longer appropriate. As a relic of the 20th century, there are now a number of experiments to prove how block chain technology can actually solve a real problem. Let me explain…

In the old financial markets, a new index based on Ethereum was proposed by the American company AFX. It aims to create a new version of Ameribor and to determine the price using real-time data from each market transaction. In fact, in the case of the Ameribor, AFX will mint two non-fungible tokens for each party to a transaction. Unlike Bitcoin, which is fungible, meaning that each token is the same, these non-fungible tokens contain information about the transaction and the counterparty. The tokens are automatically imprinted by the AFX block chain when a transaction begins, and using Ethereum’s parity smart contract language, the tokens are automatically settled when the transaction ends.

I suppose we could put Ameribor on the block chain?

The idea behind this is that AFX uses a private, approved block chain to collect real-time data on interbank lending rates, making it virtually impossible to manipulate LIBOR. This is because, instead of someone entering a number into a table once a day, LIBOR would instead be automatically generated from the real interest rates of bank transactions. So in this case, the general ledger would be used as a mechanism for collecting real-time data that is proven to be correct. The details are all still pretty fuzzy, and to be honest, you wouldn’t really need a block chain for that, but that’s another matter entirely.

Crypto-enthusiasts were thrown into a frenzy, however, when Jerome Powell, the chairman of the Federal Reserve Bank, commented that such a mechanism could, in his opinion, represent a welcome appreciation of LIBOR and interest rates in general. The purpose is to verify that the inputs used to set interest rates reflect the interest rates actually paid in the market.

Let us leave this world aside and enter the world of crypto-currencies. In the world of “decentralised finance” aka DeFi, there has been a lot of noise about a new concept known as “Automated Market Makers” (AMMs). Examples include Uniswap, Balancer and Compound – but what we see effectively is the use of market incentives to set market rates in the DeFi ecosystem.

There are a lot of people who own a bunch of crypto currencies that just sit idly in their wallets. Wouldn’t it be great if people could get some return on those assets? A bank takes deposits and lends them out to generate income. In the crypto room, a new concept called Liquidity Mining allows users to earn fees for their Ethereum-based (ERC-20) investments. Users can deposit their portfolios in an AMM and earn fees when other users leverage their portfolio as loan collateral.

However, since it is block chain country, everything is transparent, visible and openly verifiable. Instead of using agreements on paper and getting entangled in internal complexity. People create liquidity pools consisting of different types of assets, e.g. 50% ETH and 50% wBTC, and then make these LPs (liquidity pools) available to people and projects that want to take out loans. The interest rates for borrowing and lending vary in real time and people will adjust their asset allocation to optimize the return, as you can easily exchange one token for another via a decentralized exchange.

For example, users can deposit their entire portfolios into Balancer’s self-balancing LPs and earn fees when other users swap bonds for their portfolio. And in the process, a free market for interest is created. A market that uses supply and demand of different types of loan collateral in real time. So it becomes possible to create a market for prices of different types of assets instead of relying on a single price. And that is a pretty interesting concept!

To conclude

Many changes are underway in the structure of the global economy. From currencies to exchange rates, everything seems to be driven by digitalization and innovation. As always, we are watching everything with sharp eyes…

*Originally published in German at CVJ.ch