A discount call warrant belongs to the category of exotic warrants. In general, exotic warrants are the securitized combination of various options and thus a further development of classic (“vanilla”) warrants.

Structured products include strategies that are composed by combining financial instruments and derivatives. This combination allows investors to trade a complex derivative strategy in the form of a security. Structured financial products are tailored to a certain expectation regarding the market performance of the underlying instrument and have a corresponding specific risk profile.

How “Discount Calls” Work

The investment strategy underlying the discount calls is a so-called call spread, which means the purchase (long position) of a call option with a lower strike price and the simultaneous sale (short position) of a call option with the same underlying, same maturity but a higher strike price. By selling the call, the issuer collects an option premium, which is used to give the structure its eponymous characteristic, the discount.

This benefits the investor, as the price of the discount call is significantly lower than that of a normal call warrant. In return for the discount, the investor gives up an unlimited participation in the price gains of the underlying instrument, since the chance of winning is limited upwards by a cap, in contrast to a classic call. This upper price limit corresponds to the strike price of the call sold. Thus the maximum payout at maturity is the difference between the strike price of the long call and the strike price of the short call. This is because the sold position only has value at maturity if the market value of the underlying is higher than the strike price of this option, thus absorbing 1:1 the income of the long call that exceeds this level.

How “Discount Calls” Work

The investment strategy underlying the discount calls is a so-called call spread, which means the purchase (long position) of a call option with a lower strike price and the simultaneous sale (short position) of a call option with the same underlying, same maturity but a higher strike price. By selling the call, the issuer collects an option premium, which is used to give the structure its eponymous characteristic, the discount.

This benefits the investor, as the price of the discount call is significantly lower than that of a normal call warrant. In return for the discount, the investor gives up an unlimited participation in the price gains of the underlying instrument, since the chance of winning is limited upwards by a cap, in contrast to a classic call. This upper price limit corresponds to the strike price of the call sold. Thus the maximum payout at maturity is the difference between the strike price of the long call and the strike price of the short call. This is because the sold position only has value at maturity if the market value of the underlying is higher than the strike price of this option, thus absorbing 1:1 the income of the long call that exceeds this level.

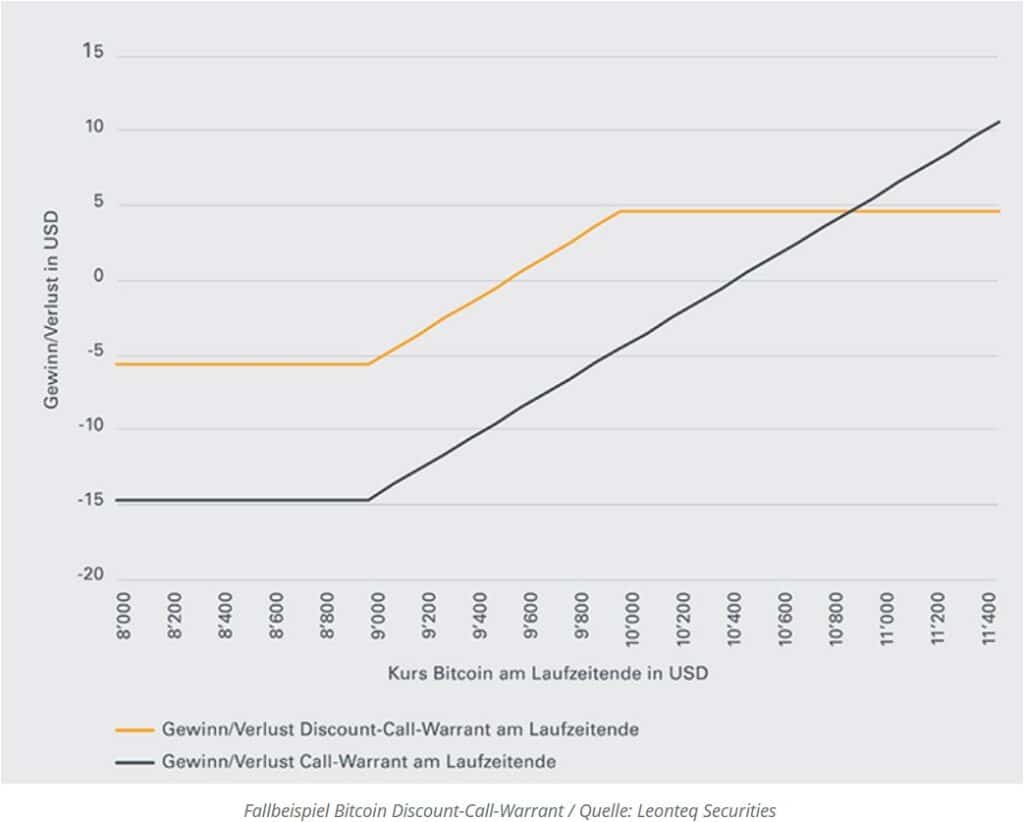

As a result, the risk/reward profile of the option differs significantly in many respects, as can be seen in the figure below.

As a result, the risk/reward profile of the option differs significantly in many respects, as can be seen in the figure below.

In principle, the discount warrant reaches the profit zone much faster than the classic warrant. If one takes the newly issued Discount Call Warrant on Bitcoin, which has a lower exercise price of USD 9,000 and an upper exercise price of USD 10,000 respectively, as a case study and assumes a purchase price of USD 5.50, the Discount Call Warrant reaches the profit zone already at a Bitcoin price of USD 9,550 at maturity. As illustrated in the previous chart, a classic call, on the other hand, only reaches the profit zone at USD 10,450, assuming a purchase price of USD 14.50.

However, the discount call reaches its maximum payout of USD 10 at a Bitcoin rate of USD 10,000, whereas the value of the call continues to rise linearly. Due to the more favorable purchase price of the Discount Call, the Bitcoin must be quoted at least at USD 10,900 at the end of the term to generate the same profit as with the Discount Call Warrant. Only if the underlying asset rises above this level is an investment in the Vanilla Call more profitable.

If the market value of the underlying at maturity is between the two strike prices, the sold call expires worthless and the repayment is calculated as the difference between the final fixing of the underlying and the strike price of the long call.

This results in the following important formulas for discount call warrants:

- Maximum repayment = (cap – exercise price) x subscription ratio

- Maximum yield = (maximum amount – purchase price) / purchase price

- Redemption amount = (Final Fixing Underlying – Strike Price) x Subscription ratio

- Break Even = Exercise price + purchase price x subscription ratio

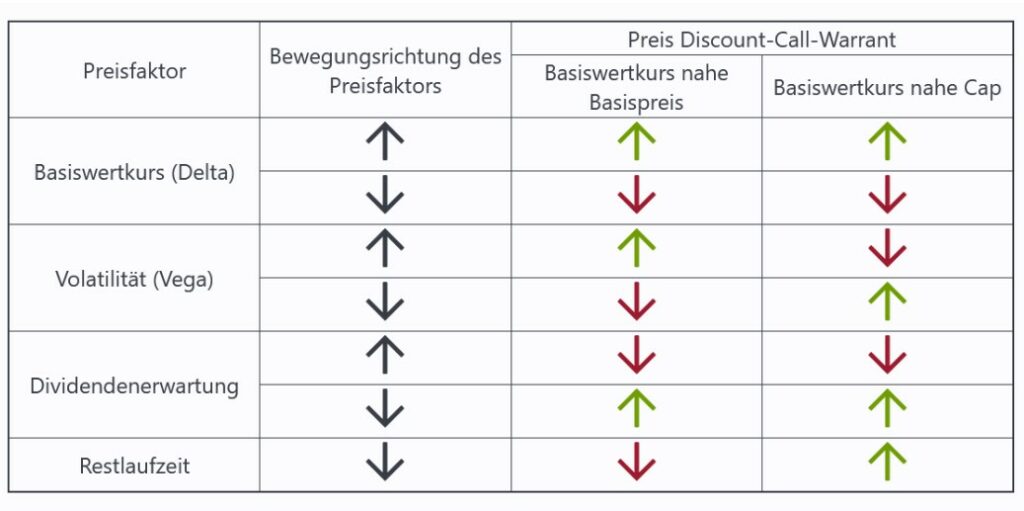

But the value of the discount call warrant is not only calculated at the end of the term. The value is also calculated during the term by calculating the value of both positions. However, the value of the two components during the term of the warrant does not consist exclusively of the intrinsic value of the options, i.e. the amount that the underlying asset quotes above the exercise price of the respective option, but also of the time value. This results (in particular) from the expected fluctuation margin (“implied volatility”), the remaining term to maturity and the dividend expectations.

The values of the individual price factors of the option positions are offset between the long position and the short position, so that the discount warrant is much more robust to changes in these price factors than a classic warrant is. This is particularly relevant if the discount warrant is not held until maturity but is sold to the issuer on the secondary market at any time during its term.

Discount call warrants on Bitcoin

The strategy, which is already common practice on traditional securities such as shares, will be available for the first time on Bitcoin via a structured product as of today. Leonteq, the provider specializing in structured investment products, is issuing a discount call warrant on Bitcoin on the SIX Swiss Exchange, thus ensuring a world premiere. The Swiss provider already made headlines with its first offer of reverse convertibles on Bitcoin, which also earned it a Swiss Derivative Award.

The newly issued discount call warrant on Bitcoin has a lower exercise price of USD 9,000 and an upper exercise price of USD 10,000 with a term of just over two months. If an investor buys the discount call warrant at the issue price of USD 5.50, the following scenarios arise:

- Scenario 1: Bitcoin closes at or above the cap on the final valuation day, so the investor receives the maximum repayment of USD 10. As the purchase price was USD 5.50, the profit is USD 4.50, which corresponds to a return of 82%.

- Scenario 2: Bitcoin closes between the underlying and the cap on the final valuation day, for example at USD 9,600, in which case the repayment is USD 6 [(price of underlying USD 9,600 – strike price USD 9,000) x subscription ratio 0.01]. At a purchase price of USD 5.50, the gain is USD 0.50, which corresponds to a yield of 9%.

- Scenario 3: Bitcoin closes at or below the strike price of 9’000 on the final valuation day, which means that the discount call expires worthless and the investor suffers a total loss.

For which scenarios are discount calls suitable?

An investment in a discount call can be useful if the investor assumes that the underlying asset will rise only moderately or the option premium is comparatively high due to increased volatility, for example, and thus ensures that the break-even point is far out of the money. There are also three possible approaches to the use of discount call warrants:

- Defensive approach: The parameters of the discount call are chosen so that the cap is below the current price of the underlying asset. Under this approach, the investor receives the maximum redemption even if the underlying falls back to the cap. The fact that a return can still be achieved even if the underlying does not perform in the assumed direction to a certain extent means that the chances of earning a return are lower compared with the other approaches.

- Neutral approach: With this approach, a cap is selected that is close to the current price of the underlying instrument. Therefore, a sideways movement or possibly a small increase in the underlying asset is sufficient to obtain the maximum repayment.

- Offensive approach: In this approach, the cap is chosen so that it is above the current price of the underlying instrument. This means that the price of the Underlying must rise to at least the Cap by the Final Fixing Date for the Investor to receive the Maximum Redemption. In this way, traders profit leveraged from increases in the Underlying, but in return the risk of loss is increased if the Underlying does not perform in the desired direction.

As with all leveraged products, discount call warrants carry the risk of total loss, even without the underlying asset becoming worthless. This occurs if the market value of the underlying is quoted below the strike price at maturity.

*Originally published in German at CVJ.ch