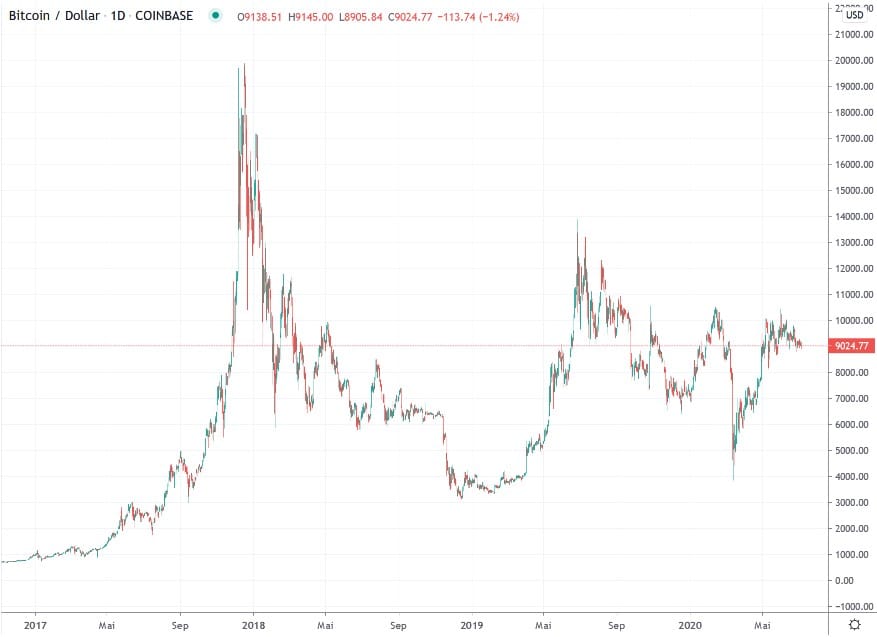

Bitcoin/USD daily basis

Bitcoin USD – At the lower end of the trading range since early May

Monday began after the short Sunday plunge below the USD 9,000 mark, with higher prices and a daily closing price at 9,100. 3 trading days followed with very tight trading ranges and slightly higher price movements, which brought the Bitcoin price to the USD 9,300 mark at midweek. The second part of the reporting week was again characterized by lower prices. However, these brought the price closer to the USD 9,000 mark again. All in all, it was another week that took place within very narrow ranges. At the end of the week, however, the trend was again towards lower daily highs and lows.

Advance to well-known resistances in the micro and macro trend

Nach dem Kurssturz von Mitte März etablierte sich eine veritable Gegenbewegung. Diese führte bis an die Widerstandszonen rund um 10’000 USD (rot). Es folgte eine erste Zurückweisung, welche den Kurs wieder an den 200-Tages-Durchschnitt (1), knapp über 8’000 USD heranführte. Mittlerweile sind weitere Versuche gescheitert, das Gebiet jenseits der 10’000 USD zu erklimmen. Ignoriert man die Intraday-Ausreisser vom 10. und 11. Mai, handelt Bitcoin seit über zwei Monaten innerhalb der Zone 8’500 – 10’000 USD.

Interessant ist die Widerstandszone um 10’000 USD in mehrfacher Hinsicht. Zum einen befindet sich hier der 0.618 Fibonacci Punkt (2) der gesamten Abwärtsbewegung, welche Ende Juni 2019 knapp unter 14’000 USD eingeläutet wurde. Zum anderen fungiert die Zone rund um 10’000 USD gleichzeitig als Bestätigung des nach wie vor bärischen Trends von tieferen Höchstkursen seit Dezember 2017 (siehe nächster Abschnitt).

Die Wichtigkeit der Widerstandszone spiegelt sich auch an der Handelsbandbreite wieder, welche sich seit Anfangs Mai innerhalb der Zone 8’500 – 10’000 USD abspielt. Zu Beobachten bleibt die Unterstützungszone rund um 8’500 USD (grün). Ein Showdown zwischen Bullen und Bären dürfte schon bald stattfinden. Sollte 8’500 als Unterstützung brechen, gilt der Bereich knapp über 8’000 USD, wo sich auch der 200-Tages-Durchschnitt (1) befindet, als nächster Support. Die positive Struktur des Mikrotrends seit dem Märztief wird mit einem erneuten Test der Zone 7’500 – 7’700 USD gefährdet. Dabei kann der Bereich um 7’000 USD als letzte Unterstützung dienen, bevor der zuversichtliche Aufbau nachhaltig Schaden nimmt.

Macro: On the threshold of a trend reversal

Bitcoin has so far failed to set a higher high in the weekly interval, which would have broken the prevailing bearish trend since December 2017. In its last attempt since the beginning of the year, the upward trend in the relevant zone at around USD 10,500 failed to establish itself. The countermovement that began in mid-March after the sharp price correction brings the price once again to the trend line, which is the result of the lower highs since the end of 2017.

If the negative macro picture is to be broken, the tendency of lower highs since 2017 must be sustainably overcome. This should be legitimized with several weekly candles above the USD 10,000 mark in order to rule out false outbreaks such as those in July 2019. The current establishment in the new range looks sustainable and should take place in the coming weeks above the 8,400 – 8,700 USD zone, as well as above the 21-week average (1) in order not to cloud the new positive picture again.

If a renewed rejection to below the USD 7,000 zone were to occur, support in the lower range of the macro trend can be expected from the 200-week average (2) at USD 5,900, which has never been breached since its inception, and from the trend line (3) of the respective lows of the upward trend since March 2017.

Disclaimer

All information in this publication is for general information purposes only. The information provided in this publication does not constitute investment advice and is not intended as such. This publication does not constitute an offer, recommendation or solicitation for an investment in any financial instrument including crypto currencies and the like and is not intended as an offer, recommendation or solicitation. The contents contained in the publication represent the personal opinion of the respective authors and are not suitable or intended as a basis for a decision.

Notice of risk

Investments and investments, especially in crypto-currencies, are generally associated with risk. The total loss of the invested capital cannot be excluded. Crypto-currencies are very volatile and can therefore be subject to extreme exchange rate fluctuations within a short period of time.