Blockchain networks are public infrastructures maintained by economically motivated actors. Until today, the predominant method for ensuring the security and continuous operation of large Blockchains is proof-of-work mining. Proof of Work Mining (PoW) is the core innovation behind Bitcoin, making the existence of stateless, digital money possible for the first time. In recent months and years, Blockchain networks have evolved to use various incentive models to maintain their infrastructure without the need for centralized management. A clearly emerging trend is the migration to Proof-of-Stake networks (PoS). A proof-of-stake consensus algorithm requires participants to provide monetary collateral rather than computing power in the form of energy, as is the case with proof-of-work.

Staking requires that users keep their tokens in a kind of escrow account. This entitles them to participate in a share of the total payout generated by the network. This incentive model can be used in various contexts; from deciding who will participate in the consensus (as is the case with smart contract platforms such as Tezos, Cosmos, Polkadot and soon Ethereum), to application-specific use cases such as providing Blockchain data for front-end applications (The Graph), or distributing work in on-demand video transcoding (Livepeer).

The development of the staking economy

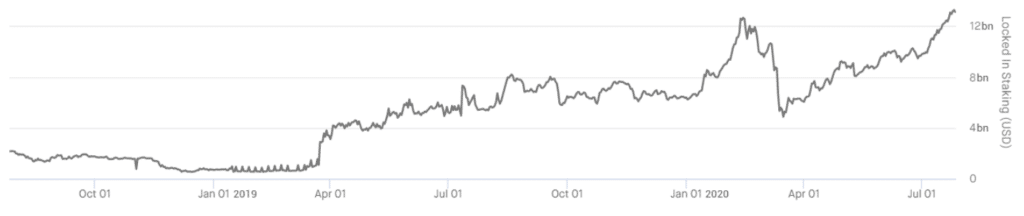

The concept of staking has a long history going back to 2012 – the switch to proof-of-stake is a core part of Ethereum’s plan and is even mentioned in the 2013 white paper. A turning point came in 2018/19 when Tezos and Cosmos, two prestigious projects with large communities, launched an industry of staking providers – often called validators or node operators.

Since then, the number of staking networks has steadily increased. With few exceptions, most of the newer protocols are based on some form of staking. This becomes clear when you look at the cumulative value of the tokens that have been included in staking over time. At the time of writing this article, the assets used for staking in various networks have grown to over $12 billion.

This trend is largely driven by the introduction of new staking networks and is expected to continue due to new market launches and migrations to proof-of-stake, such as those planned for Ethereum 2.0.

With $12 billion at stake and an average annual return of 12.5%, annualized revenues in decentralized staking networks are already around $1.5 billion per year, which has led to the emergence of a whole new industry. It focuses on making it easier for token holders to participate in PoS networks through staking.

The staking industry

Staking requires that users temporarily “lock up” their tokens and securely operate the node infrastructure to obtain network rewards. Since most token owners do not have the skills or resources required to do this, several options for participating in staking have emerged:

- Own infrastructure: Token holders can operate their own nodes. This usually requires extensive knowledge of network protocols and expertise in building a secure, 24/7 infrastructure, so this option is only suitable for a small subset of large owners and/or technology enthusiasts.

- Custody providers: Many centralised exchanges (e.g. Binance or Kraken) and custody providers (e.g. Anchorage or Coinbase Custody) offer staking and allow users to earn rewards for storing tokens on their platforms.

- Independent staking providers: In most staking networks, token holders can outsource the operation of the node infrastructure to independent providers such as Chorus One or Figment Networks without relinquishing control. By sending a specific transaction, token owners can delegate their rights for a fee that is automatically deducted from the network.

- Node service providers: Finally, services such as Bison Trails and Blockdaemon enable token holders to set up and manage their own nodes on different protocols. These white-label solutions are usually aimed at parties interested in offering staking to their customers under their branding (e.g. custodians, exchanges, wallets, etc.).

Which of these options makes sense strongly depends on the stakeholder and its objectives. If you are interested in learning more about this topic, I recommend that you take a look at Staking Provider Stakefish’s guide, which provides good guidance on choosing a validator to evaluate the different options.

Conclusion

Crypto assets are evolving from purely speculative investments to productive purposes. Whether it is staking, providing liquidity or lending tokens in decentralized finance, crypto-currency holders need to consider how to use their assets in the emerging decentralized economy.

*Originally published in German at CVJ.ch