A growing acceptance of Stablecoins could be the next step in a global financialisation, after private actors started to create dollar derivatives in the 1960s. Will crypto-dollarization lead to an upgrade of the Eurodollar system?

It sounds paradoxical at first glance: while the Fed creates masses of dollars out of nothing, the greenback is not widely available globally. There is an inherent shortage of dollars. Will Stablecoins and CBDCs jump into the breach in the medium term to make the reserve currency more readily available globally? Will Bitcoin and Ether play a decisive role as new forms of collateralization?

The dollar is now the strongest national Fiat currency in the world. It is currently devouring all other weaker national currencies one by one. This process will accelerate in the future and, ironically, be reinforced by the dollarization of public blockchains. Until the day when the dollar devours itself and open, non-state digital currencies will eventually take its place. How could that happen?

Dollar Chains

A crushing dollar yoke currently weighs on the shoulders of our planet today. It was after the two world wars that the dollar began its meteoric rise to global dominance. The United States held not only the largest gold reserves in the world, but also the largest share of productive capital. Post-war Europe imported goods from the United States and paid for them in dollars. At the same time, the United States imported oil in large quantities and paid the bill in dollars. Until the end of Bretton Woods, the dollar was the last currency still linked, albeit indirectly, to gold.

All this made the dollar the world’s reserve currency. Even the de facto declaration of bankruptcy by the USA, after closing the gold window and definitely moving away from the gold standard, did not cause lasting damage to the dollar. On the contrary: to this day, US government bonds, which form the deepest capital market in the world, serve as a safe haven in times of financial turbulence.

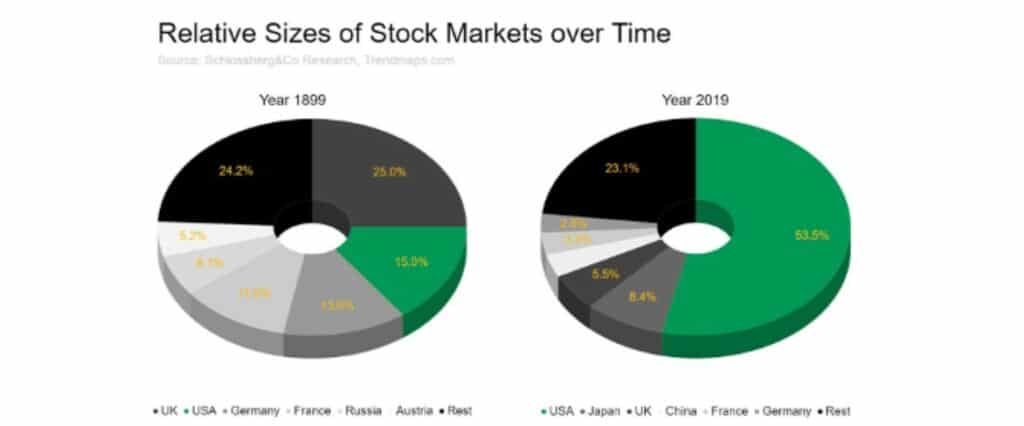

In his carefully researched book, Eswar S. Prasad shows how the US dollar is increasingly putting the global financial world under pressure. A dysfunctional international monetary system and US foreign policy in the style of the world policeman have paradoxically strengthened the importance of the dollar. The shift in the relative size of stock markets over the last 100 years is indicative of this. Since huge amounts of foreign financial capital are tied up in dollar assets, especially US government securities, other countries have an inherent incentive to prevent a dollar crash if possible.

The dollar trap into which the world has fallen is actually manifesting itself as a huge dollar shortage that companies and investors are struggling with. Anyone who wants to initiate and finance a project on a global level today must do so almost inevitably via the dollar. As discussed elsewhere, there is now a global dollar debt of almost $60 trillion, which in turn creates a huge demand for dollars to pay off this debt.

Since the dollar is the current reserve currency with the deepest and most liquid capital market, people around the world have been borrowing in dollars. This is a growing cycle. However, as we must suspect: The pitcher goes to the well until it breaks and this was first seen in 2007. The financial crisis revealed the problems of a huge shadow banking sector where suddenly there was no more liquidity and the players were desperately fighting for dollars.

Central banks: Too little potential

With the Corona crisis, this financing problem became clear once again: companies, banks and other players around the world were dependent on the so-called dealers in the markets providing sufficient liquidity to maintain market liquidity and thus the economy and world trade.

While central banks move in step and provide liquidity to markets around the world, they are all dependent on the US Federal Reserve. It is imperative that the Federal Reserve provides enough dollars for the system, as all other national currencies are virtually dollar derivatives, as economist Keith Weiner puts it.

Both the central banks and the Fed officials are beginning to wake up to this reality. That is why the Federal Reserve has extended its so-called swap lines and even added more central banks to them. Only through these vehicles can an attempt be made to bring dollar liquidity to where it is really needed.

However, it seems far from being admitted at the highest political level that everything depends on the US, the US central bank and ultimately on the US dollar. And even the Fed still has to accept that it has to take the whole world on its balance sheet de facto. However, the US Federal Reserve is still seen as much more potent than it actually is. Trying to bail the whole world out by constantly printing its own liabilities is too big a task even for the Fed.

Lender of last resort

As the monetary theorist Perry Mehrling explains in his informative book, private dealers in the form of financial market players are important participants who borrow on the money market in order to finance their market-making operations on the capital markets. They act as private lenders of last resort. In a sense, they provide a liquidity safety net for the markets. The existence of such private actors, who operate primarily through the global shadow banking system, is mainly due to the following fact: Although central banks are always in the process of maintaining market liquidity for government debt, they have so far tended to neglect this task for private debt.

Notwithstanding the fact that the current instability in private debt is a problem that central banks themselves have caused with their low interest rate policy, unlimited support for corporate debt would finally undermine the pricing process and thus the market. Although the central banks have done just that with their current emergency measures, they would rather withdraw from their role as lenders of last resort. Ten years after the 2008 crisis, an attempt was made to carry out quantitative tightening, but it did not work.

Whether it was the maneuvering of the central banks, private financial actors of all kinds have always tried to help themselves. This is the reason for the enormous “financialization” of the world over the past decades. Financial innovations such as the certificate of deposit, bank commercial paper and, above all, Eurodollar loans have emerged.

The Euro-dollar system

As described by financial trader Jeffrey Snider: The emergence of the Eurodollar system was a direct result of the Fed’s inability to meet the relentless global demand for additional dollars. Eurodollars are one of the most effective ways for private actors to alleviate today’s global dollar shortage. According to Snider, there would be two “different” dollars today: The US dollar, which is under the supervision of the Federal Reserve. And the “offshore dollars”, which are created and used outside the jurisdiction of the US Federal Reserve. The growing demand for offshore “dollars” over the past few decades ultimately reflects a growing demand for dollars.

According to fund manager Brent Johnson, it is precisely this demand for dollars, also known as the “Short Squeeze of the Century”, that will accelerate. The demand for dollars will increase as more and more people will have to service their debts.

The impact of Covid19 , supply chain disruption, the slowdown in world trade and economic deflation are likely to make it increasingly difficult for borrowers around the world to obtain dollars for their dollar-denominated debt.

Macro investor Raoul Pal points out: “In the future, cash flows may not be as secure as they used to be. If cash flows disappear, people and companies will have too little money to repay their debts. This would narrow the bottleneck and exacerbate the problem. Especially in emerging markets, the dollar debt is high. The demand for dollars in these countries will cause local currencies around the world to steadily weaken against the greenback. Capital controls that make it more difficult for debtors to access dollars are therefore likely to be inevitable.

Huge tailwind for Stablecoins

Just as inevitably, however, Bitcoin and Ethereum will be used as a common weapon in the fight against this global dollar shortage. In their fight against the dollar shortage, marginal debtors will discover the possibilities of these public block chains. Especially US stablecoins running on Ethereum will be a way to get dollar exposure or dollar proxies. Since these assets are digital by nature, they also make it easier to circumvent capital controls.

While the so-called dollar milkshake theory will become a reality in practice, this will inevitably promote digital thickshake theory, as described by Alexander Saunders of Nuggets News. In a way, one would have to talk much more of a digital smoothie theory, since public blockchains greatly simplify the global money transfer via cryptoassets. The traditional dollar banking system with all its regulations and inefficiencies is actually subject to the thickshake theory.

So do Bitcoin and Ethereum represent the next macro-evolutionary step in the future of global finance (which could also turn out to be a revolutionary step)? This process is still hardly visible to anyone, but the dollarization of public block chains has already begun.

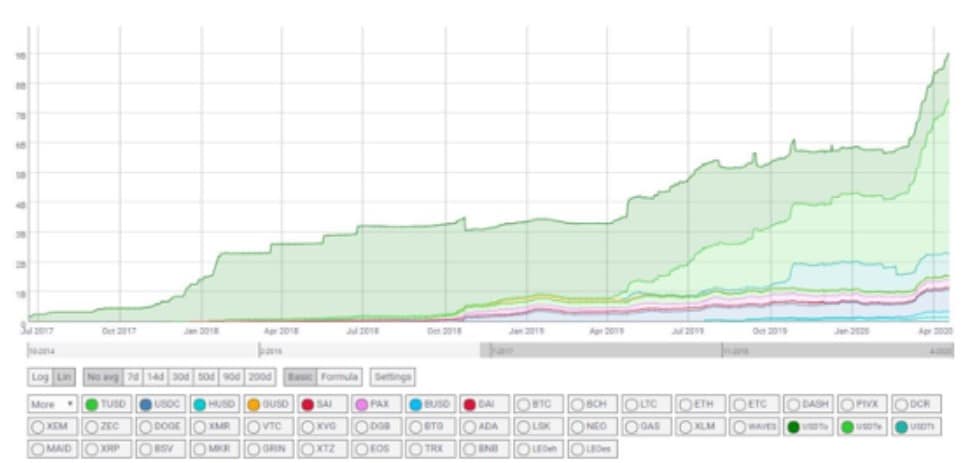

In the last two years, the market capitalization of Stablecoins has exploded. There is already speculation that tether could exceed the market capitalization of Ethereum or even Bitcoin in the medium term because the demand for synthetic dollars and dollar approximations will be enormous. To use a term from blogger John Paul Koning: Hyper-stablecoinization represents, in a sense, the upgrade for Eurodollar banking. Once again it is private actors within the financial system who are using innovative instruments to ensure that dollars can be obtained worldwide at any time. Will the Eurodollar be followed by dollar stablecoins?

The digital dollar should then follow as the last iteration in the form of a CBDC. It remains to be seen how restrictive the issuance and handling of the CBDC will be.

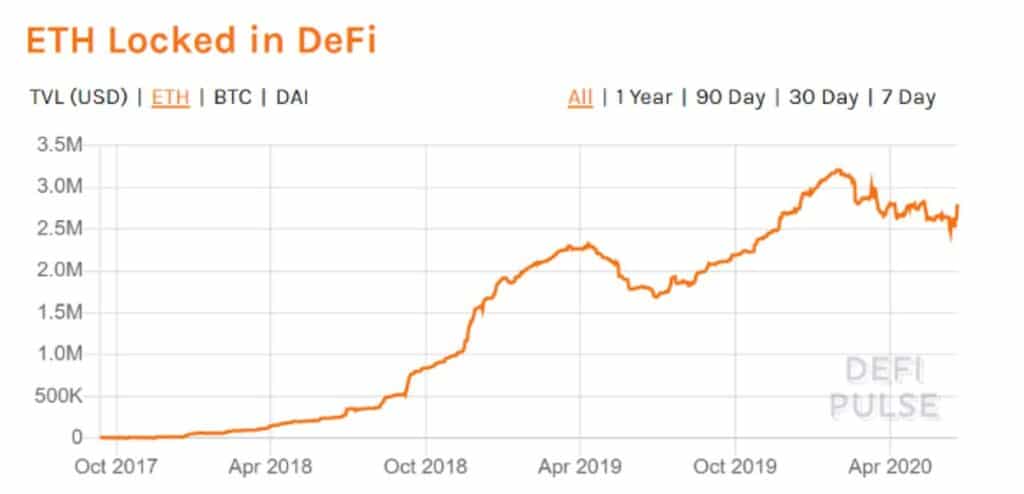

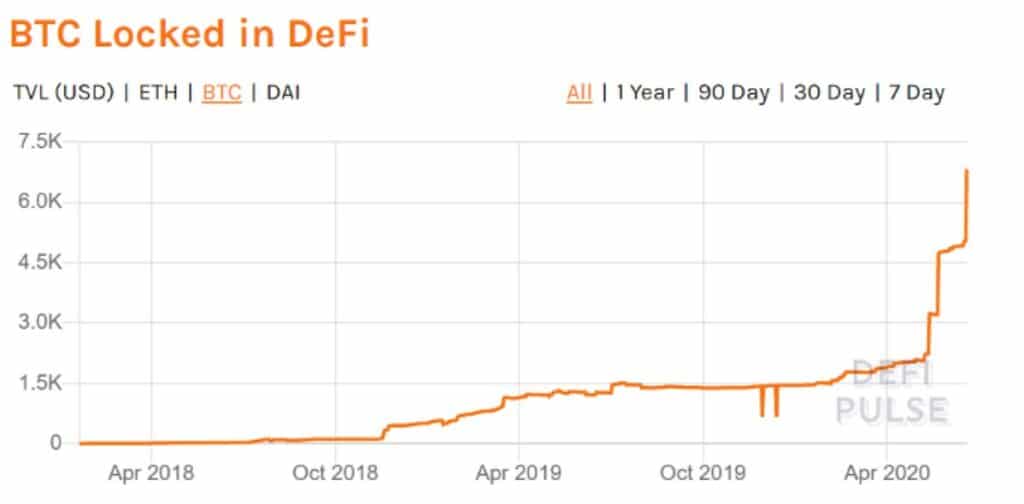

Just as the shadow banking system provides an opportunity for private actors to use collaterals to create synthetic dollars and dollar derivatives, the programmability of public block chains provides new opportunities to further develop this game. Already today, Bitcoin and ether serve as collateral to create dollar deposits and dollar loans. More and more of these crypto assets are finding their way into the DeFi world (Decentralized Finance), where they can be used as collateral and hyper-crypto dollarization can be pushed forward.

*Originally published in German at CVJ.ch