As the Ethereum networks prepare for the start of phase 0 of Ethereum 2.0, we discuss the importance of this new technology and its impact on the ETH Prize.

This transition of Ethereum is one of the most ambitious and challenging tasks in the Blockchain industry with the potential to revolutionize distributed networks.

What is Ethereum 2.0?

Simply put, Ethereum 2.0 or Serenity is a network update that aims to make Ethereum more scalable by introducing new PoS protocols along with upgrades such as sharding, virtual machine and more. In this article we will guide you through the updates and changes in Ethereum and the expected impact on the price.

Ethereum was the first Blockchain designed to use Smart Contracts on its platform, allowing individuals to create distributed applications (dApps) on the Blockchain platform, similar to an application on an Android or iOS system.

Inspired by Bitcoin, Ethereum built in proof-of-work (PoW) as a consensus mechanism, but when dApp usage was high (crypto kitties), PoW caused the Ethereum Blockchain to expand [1], slowing down the network. To overcome this scalability problem, Ethereum will move from PoW to PoS consensus mechanism along with other network upgrades such as sharding [2] and eWASH.

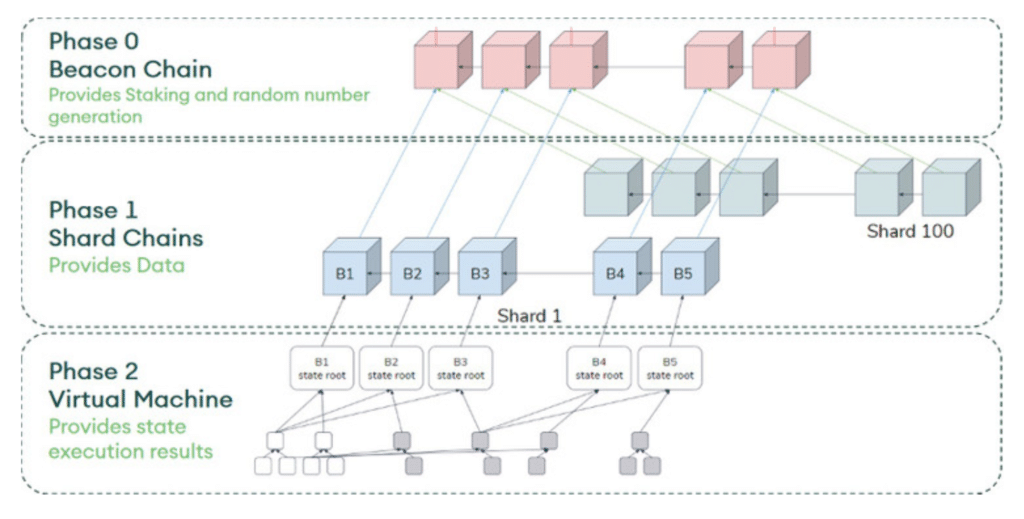

Ethereum 2.0 is planned to be introduced in phases (Figure 1), and the expected release date for phase 0 is later this year, while the dates of other releases have not yet been announced.

Figure 1: Ethereum 2.0 timeline

SEBA Bank offers banks, asset managers and qualified investors comprehensive services with secure access to digital assets

Source: SEBA Research

Functionality of Ethereum 2.0 simplified

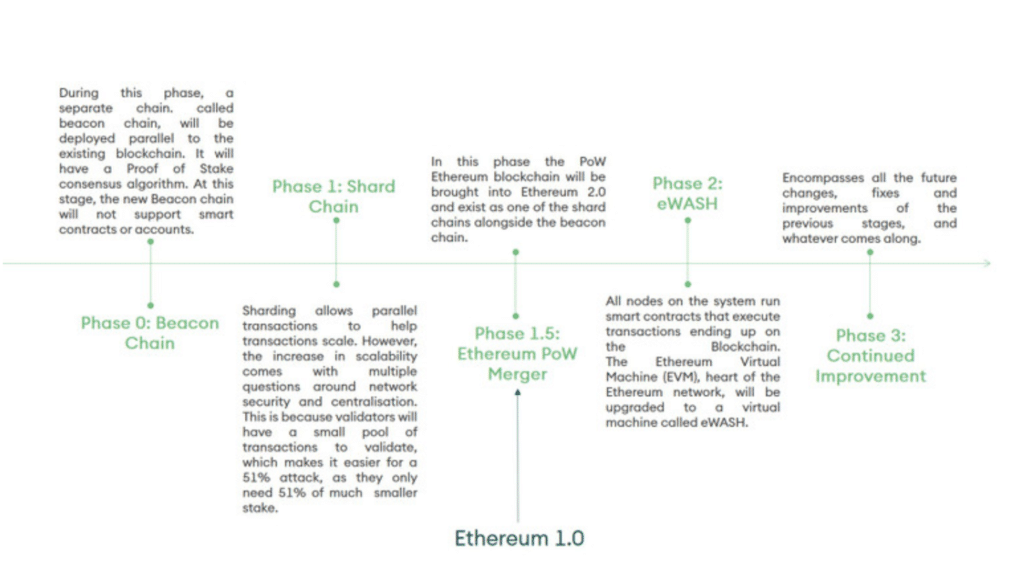

From an architectural point of view, Ethereum 2.0 will look similar to Figure 2. Every transaction and execution of Smart Contracts will be done through the virtual machine (eWASH). The execution results generated by the virtual machine are stored in a Blockwithin a shard chain. Several shard chains [3] will exist and work in parallel. In the last phase, all shard chains will be connected to a beacon chain, in which different shards will be collected and stored. In the following section we will learn more about the Beacon Chain of Ethereum 2.0.

Figure 2: Ethereum 2.0 architecture

Phase 0: Beacon Chain and its conditions

The Beacon Chain will be the first part of the Ethereum 2.0 update. It will implement PoS mechanisms and manage the register of validators within the network. During this phase, both the Ethereum (current Blockchain) and the Ethereum 2.0 Blockchains will exist in parallel. In phase 0, the beacon chain will be of limited use as no transactions, smart contracts, or dApps will be running. This is to ensure that the PoS mechanism is subjected to rigorous live testing and attracts enough validators for the later phases. During this phase, anyone who intends to become a validator in the network can convert their 32 ETH to 32 ETH2 [4].

Economic principles of Ethereum 2.0

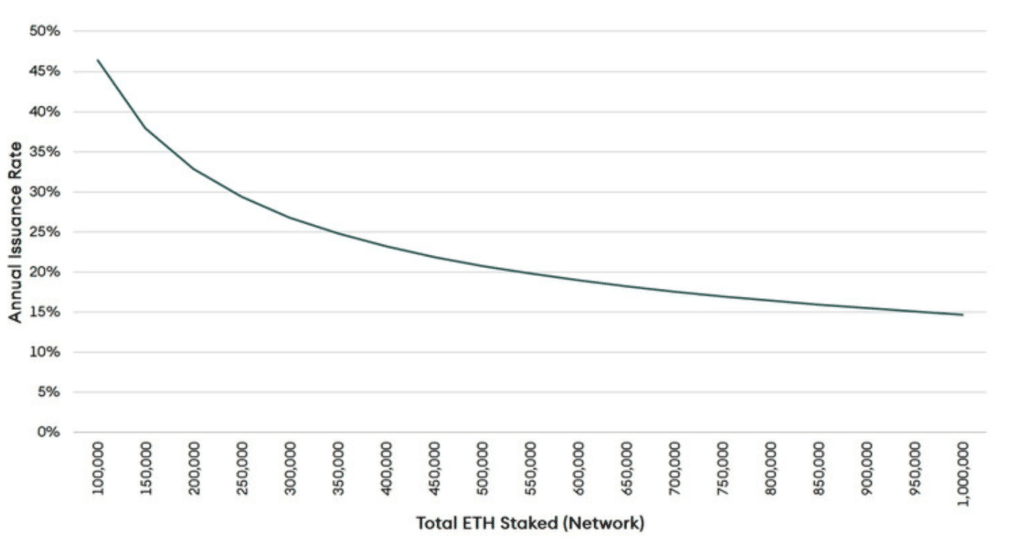

During phase 0, two Ethereum chains will exist simultaneously, one PoW and another as PoS, running independently. Both networks will have their own supply and inflation rates; therefore, with the introduction of Ethereum 2.0, the overall inflation rate of Ethereum (i.e. Ethereum 1.0 and 2.0 together) will increase until both chains merge (i.e. phase 1.5). The output rate of Ethereum 2.0 will directly depend on the number of ETH2s that are connected to the network at any given time. The ratio between the output rate and the number of ETHs involved in Ethereum 2.0 is defined as follows

S = 181 × √SETH2

where S stands for the number of ETHs delivered and SETH2 for the number of ETH2s that are clocked. A higher rate of initial offer (when there are few validators) will encourage ETH owners to switch to the Ethereum 2.0 beacon chains and receive higher rewards. Figure 3 shows the relationship between the offer and the number of ETHs involved in the chain. The number of ETH2 involved is directly proportional to the reward for Validators (offer).

Figure 3: Validator Economy – Phase 0

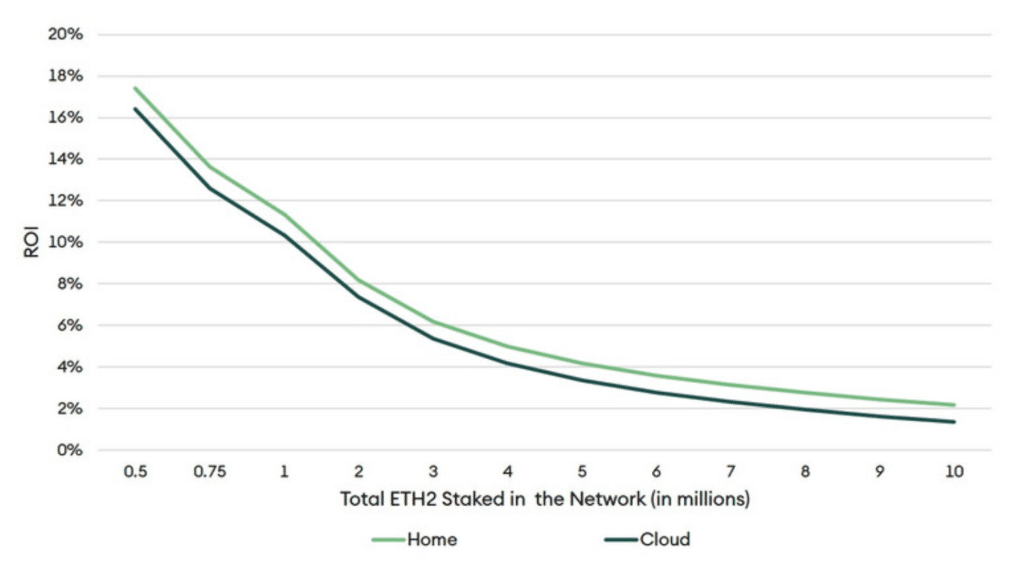

Ethereum 2.0 staking can be performed either at home with a personal / specialized computer or through cloud computing. Both methods have their advantages and disadvantages in terms of fixed costs, variable costs, uptime, reliability, etc. Figure 4 shows how much a validator should earn in both home and cloud based operations, taking into account different levels of overall ETH2 staking and other assumptions. Readers can refer to the staking calculator spreadsheet to better understand other assumptions and adapt them to their needs. These rates are subject to variable changes, and readers may refer to this article from SEBA: Ethereum 2.0: Where the rubber meets the road, to better understand these variables.

Figure 4: Staking profitability

Impact of Ethereum 2.0 on ETH

Now that we have understood the work dynamics and conditions within the Ethereum 2.0 Beacon Chain, we discuss how the introduction of phase 0 can affect the ETH price. Several factors can increase the ETH price in the short term, some of which are described below.

Offer

Ethereum 2.0 requires validators to convert ETH to ETH2 and transfer it to the new PoS Blockchain; furthermore ETH2 will be locked until the start of phase 2. This will result in a reduction of the circulating ether supply in the PoW chain. In the Ethereum community, the Ethereum Improvement Proposal (EIP) 1559 proposes to reduce the Ethereum supply in the PoW network by burning a large part of the transaction fee. This will reduce the fee that miners receive for validating transactions, while the fee paid by users will remain the same. This should create an incentive for users to switch to PoS-based Blockchain. However, this proposal has not yet been implemented. Should it be implemented before the start of phase 1, the PoW-based ethereum could result in a reduction of the offer. Overall, a reduced circulating offer from ETH should push the price upwards.

Demand

In phase 0, the Beacon Chain has no use in the real world because no transactions, smart contracts or dApps can be executed. For this reason, the demand for Ethereum will not decrease. On the contrary, the demand for Ethereum may increase in the short term as investors, speculators and validators start buying ETH before the Beacon Chain is launched. This increased interest in Ethereum can already be observed: Since the beginning of the year, Grayscale has bought about 873,723 ETH.

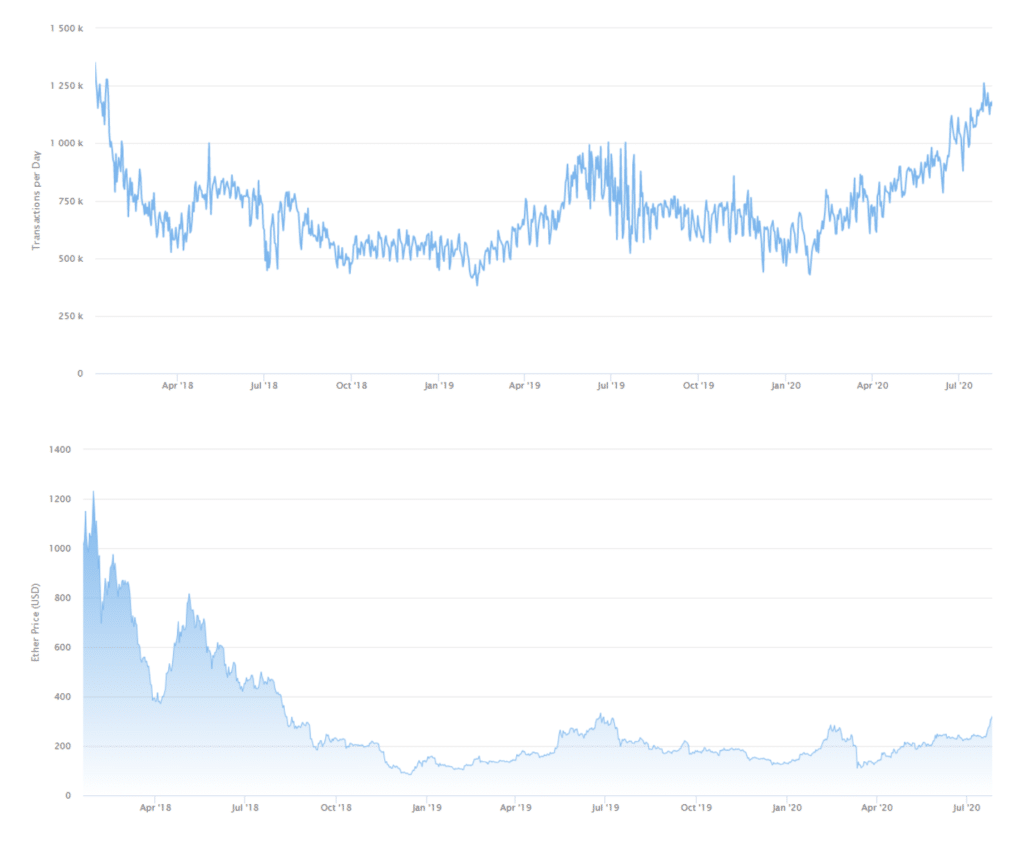

In addition, the network currently has a two-year high in terms of the number of network transactions at a lower price (Figure 5).

Figure 5: Ethereum daily transactions and daily price

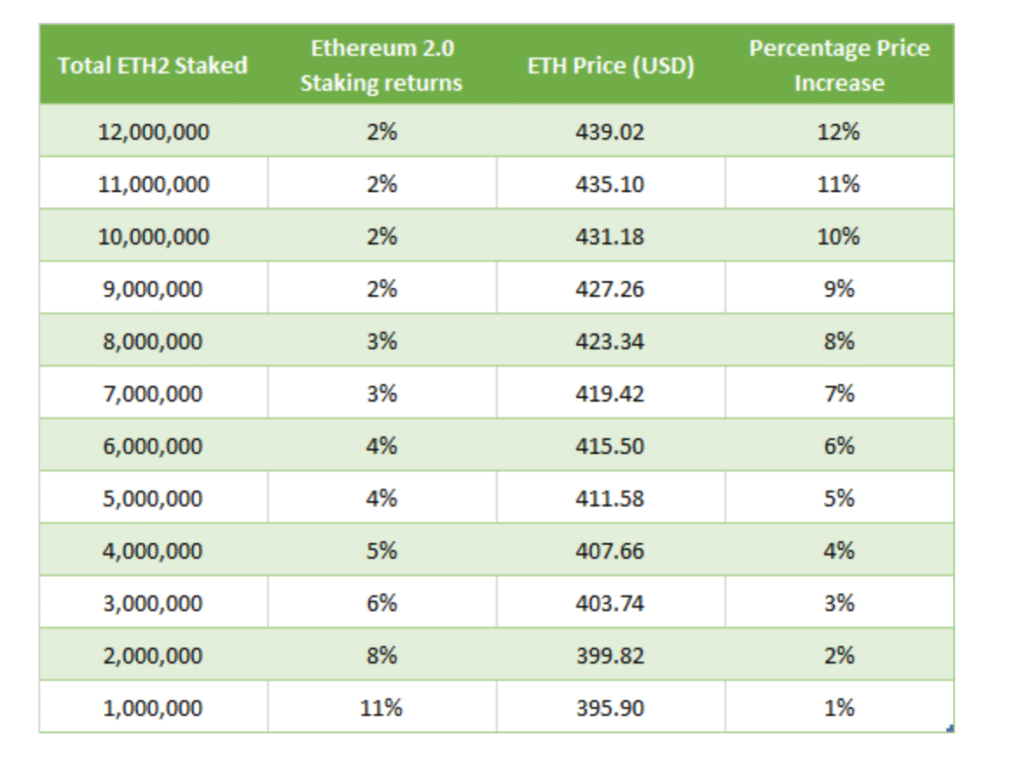

In the short to medium term, the demand side creates demand pressure. The supply side also generates bullish pressure in the medium term, provided that EIP 1559 is also implemented. As a result, ETH could see prices rise in the short to medium term. Table 1 shows estimates of the price impact on ETH, as the circulating supply decreases with the number of ETHs converted and stagnating in Ethereum 2.0 and assuming that total market capitalisation and demand remain constant.

Table 1: Possible price impact of the Ethereum 2.0 staking on ETH

In the longer term (i.e. after phase 2), the price impact of Ethereum 2.0 on ETH may be negative, as the benefit of the PoW network will decrease as transactions, smart contracts and dApps are launched in the PoS network. The migration of the Ethereum network to PoS will be time consuming and difficult and will lead to the blocking of capital (staking). Therefore, it should be avoided to set all Ethereum stocks to Ethereum 2.0. For long-term investors, it would be advisable to invest part of their ETH in Ethereum 2.0 in order to benefit from the high initial returns while keeping some ETH in the PoW chain. Investors should also keep in mind that this transition is one of the most ambitious projects in the field of digital assets. Failure to implement it or any delays could have a negative impact on the price of ETH and lead to the capital on Ethereum 2.0 being blocked indefinitely. Investors and traders may also consider the option to hold Ethereum and benefit from the likely short to medium term price increase until the Beacon Chain is released.

Become a “Validator”

The entry barrier to become a validator for Ethereum 2.0 is relatively low. To become a validator, you need to meet certain financial and hardware requirements. The whole process is clarified by the release of the Beacon Chain. However, below are the basic requirements to become a validator of the Beacon Chain.

- With this deposit contract, the validator must convert 32 ETH to ETH2.

- Each validator must stake 32 ETH2. More than 32 ETH do not lead to additional revenues, therefore staking should be in multiples of 32.

- The validators can use cloud computing or personal hardware for staking. The following personal hardware specifications are recommended [5]:

- Processor: Intel Core i7-4770 or AMD FX-8310 or better

- Working memory: 8 GB RAM

- Storage space: 100 GB available storage space on SSD

Internet: Broadband connection

Conclusion

Now that the halving of the Bitcoin reward is complete, many investors are looking at Ethereum as the next business and investment opportunity. A smooth release of the Beacon Chain will be a positive step towards Ethereum’s migration from PoW to PoS. In the medium to short term, we expect a price increase for ETH, as the PoS-based Ethereum 2.0 will not be fully functional before phase 2 is implemented. During this period, the reduced supply and increased demand for Ethereum should increase the price. In contrast, the introduction of Ethereum 2.0 may lead to a price reduction in the long run as users move from the PoW to the PoS chain. However, predicting these changes is difficult due to the many factors affecting coin swap and interoperability features.

1] Blockchain bloat is a condition where the size of stored data becomes very large due to the increasing number of users and transactions. If the Blockchain bloat is strong, the transaction speed suffers.

2] In a database management system, sharding is a type of database partitioning in which information is divided or partitioned into smaller data, also called shards. These shards are not only smaller, but can also be processed faster and are therefore easier to handle.

3] Here we show 100 shard chains, but the actual number may vary as the details of Phase 1 are not yet finalized.

4] ETH refers to the currency used in the Ethereum 1.0 network, and ETH2 refers to the currency used in the Ethereum 2.0 network.

5] Based on the test network requirements of the Beacon Chain

*Originally published in German at CVJ.ch