Sector analysis March 2020

On 27 March 2020, the FTX exchange rebalanced its old/mid/shit indices. In addition, a weight limit of 20% for a single coin was introduced in each of the indices. In addition to the quarterly rebalancing, all other changes are published 24 hours in advance.

Old index

The coins that are still in the old index are BCH, NBB, BSV, EOS, ETH, LTC and XRP. Leo and TRX were included in the Mid Index.

New Coins in the Mid-Index of the sector analysis

All three major exchangecoins LEO, OKB and HT were consolidated in the mid index. The number of constituents within the index remains unchanged at 24.

New Coins in the Shit Index of the Sector Analysis

The index constituents were reduced from 58 to 51. New and interesting coins with a decent annual performance have been added. The HBAR (Hedera Hashgraph) has reached 220% since the beginning of the year. Hedera is created in the hashgraph consensus. The introduction in 2018 was a private sale with several rounds of financing and the Genesis block was created on 16 September 2019. The investor base is global. The outstanding offer is capped, with the founders and the project being 80% owned by the investors. A total of 17.5% is owned by investors and the remaining 2.5% is used for air drops and rewards.

Another prominent coin, BEAM, has also been included. BEAM was originally an experiment, with Mimblewimble providing better scalability of the base layer by reducing the amount of data. It is a proof-of-work coin with a disinflationary emission schedule. The genesis block was created in January 2019 and the first hardfork was successfully completed on August 15, 2019. The organisation is based in Singapore and Israel, but there are also investors in Switzerland.

The annual performance of BEAM is minus 49.5%. TOMO (Tomo Chain) is a scalable layer of Ethereum with a low transaction fee, fast confirmation time and double validation benefits. It provides an ecosystem of multiple DApps running on the Tomo blockchain infrastructure. The total supply is capped, with the founders and the project owning 28% and 17% being used for AirDrops and other rewards. Investors in Asia, Europe and the USA own 55%. The annual performance of the coin is minus 42%.

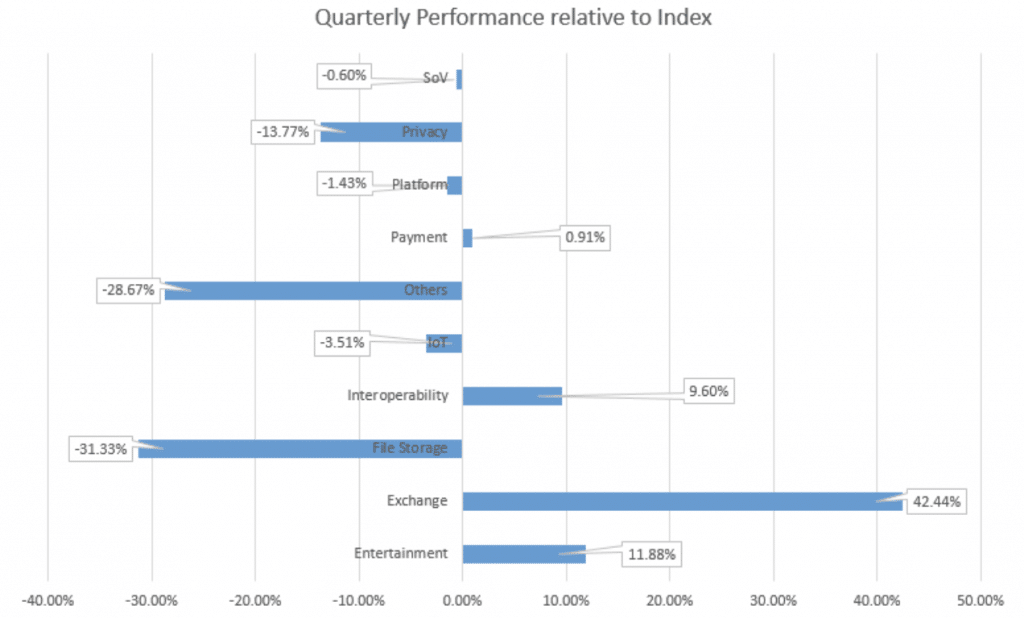

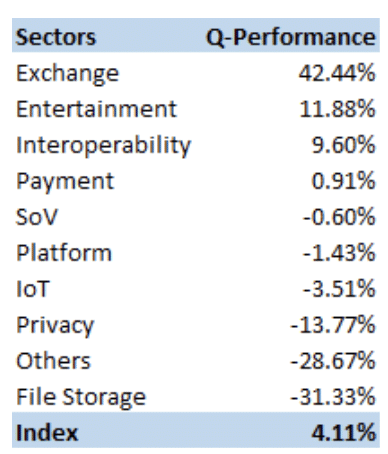

Sector analysis quarterly performance

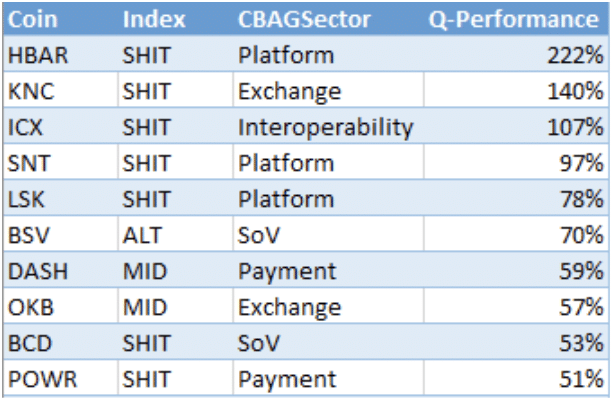

Sector analysis winners

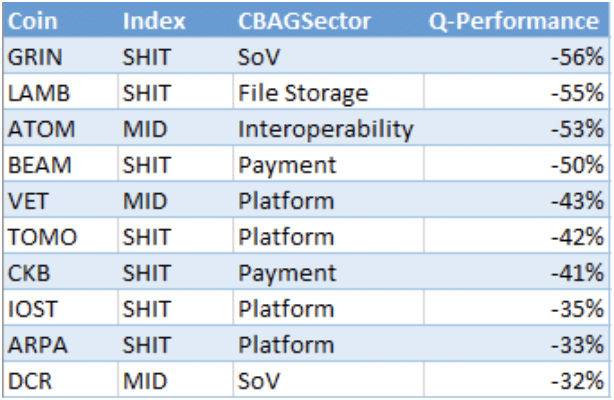

Sector analysis Losers

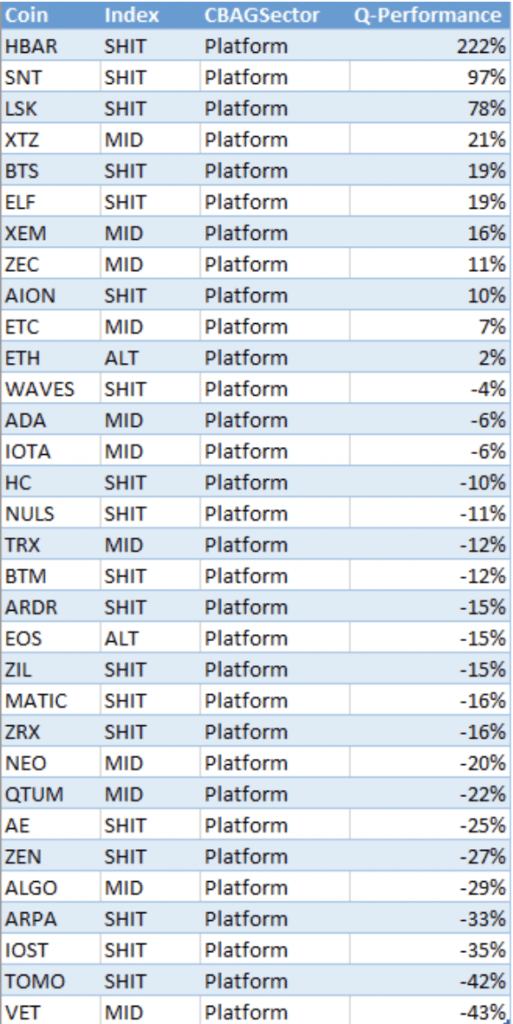

Platform

This sector lists the most coins. Some of them appear in the top 10 list, others are also part of the list of lost coins. If you look at the quarterly performance figures, you can see that more coins are in negative territory, but some of them are doing very well, ensuring that the sector has only lost 1.43% against the index. Overall, the platform sector has been fairly neutral to the other sectors.

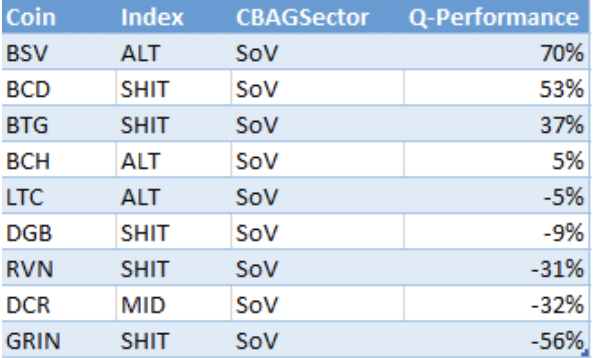

SoV (Store of Value)

This is a well diversified sector with a normal distribution of benefits. However, it is a little surprising to see Bitcoin SV as the best performer. This coin clearly surpasses its “big brother” Bitcoin Cash.

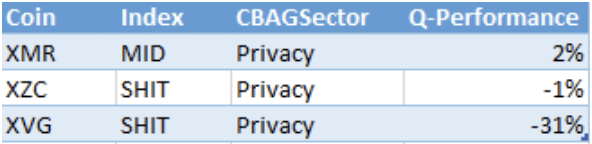

Privacy

This sector has lost some of its shine since the beginning of the year. It is well below the index, but also below the benchmark BTC$, which fell by 10% in Q1 2020.

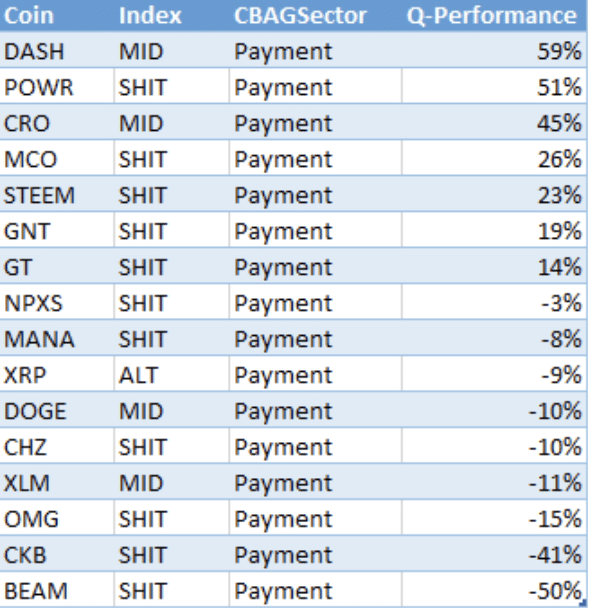

Payment

Another fairly balanced sector with a rather normal distribution in terms of the performance of the individual components.

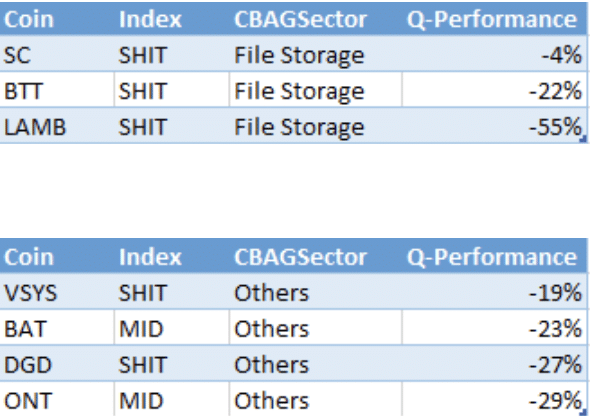

File Storage & Others

The two worst performing sectors had a really bad first quarter. Most of the coins were down by double digits, with the exception of the SC coin. Perhaps this has to do with the fact that the supply curve (inflation) has flattened significantly after the end of 2019.

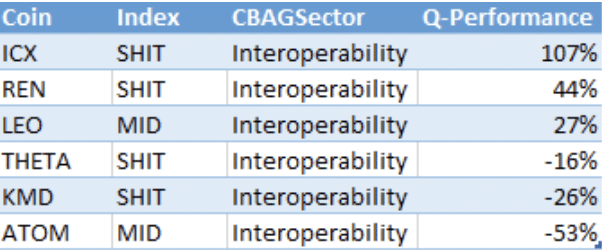

Interoperability

The main driving force behind the performance of this sector was ICX.

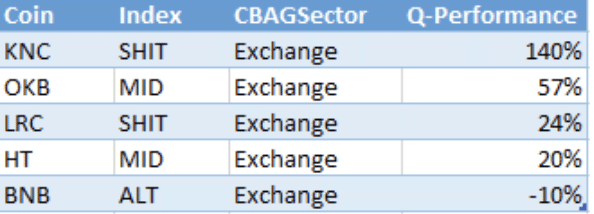

Exchange

This sector was the absolute winner in the first quarter of 2019. The overall performance was 42% better than the index. KNC (Kyber Network) has reached 140% since the beginning of the year. Kyber Network is a decentralised exchange based on Ethereum, which focuses on the fast onchain execution of transactions. KNC was listed on Coinbase in February 2019 and announced that it will be stacking and upgrading to a DAO in Q2 2020. The trading volume of the Coin has so far exceeded $100 million. In general, the exchange coins appear to be a stable investment in harsh market conditions, as the trading volume of the exchanges is constantly increasing and the exchanges offer reduced transaction fees when using their coins.

Copyright © 2020 | Crypto Broker AG | All rights reserved.

This publication and its contents, including all names, logos, designs and trademarks and all associated intellectual property and other rights are the property of Crypto Broker AG or third parties. They may not be reproduced or reused without their prior consent.

Disclaimer

All information in this publication is for general information purposes only. The information provided in this publication does not constitute investment advice and is not intended as such. This publication does not constitute, and is not intended as, an offer or recommendation or solicitation of an investment in any financial instrument including crypto currencies and the like. This publication is not intended for advertising purposes, but serves only as general information. The content contained in the publication represents the personal opinion of the respective authors and is not suitable or intended as a basis for decision-making. All descriptions, examples and calculations in this publication are for illustrative purposes only. Although every care has been taken in the preparation of this publication to ensure that the information is accurate and not misleading at the time of publication, Crypto Broker AG makes no warranty or guarantee, either express or implied, with respect to the information contained herein, its marketability or suitability for a particular purpose, or with respect to its accuracy, correctness, quality, completeness or timeliness. Crypto Broker AG excludes all liability and responsibility for the use of the information contained in the publication, including by third parties, in connection with trading or other activities, and also for any errors or omissions contained in this publication.

Risk Note

Investments and investments, especially in crypto-currencies, are always associated with risk. The total loss of the invested capital cannot be excluded. Crypto-currencies are very volatile and can therefore be subject to extreme exchange rate fluctuations within a short period of time. Any use of the information contained in this publication is exclusively and solely at the user’s own risk. A user should always be aware of the associated risks before making any investment and investment decisions and should seek appropriate advice if necessary.

*Originally published in German at CVJ.ch