“Central banks printing lots of money.” This is a phrase you hear almost every day these days. But how exactly is new money created and where does money come from? Our monetary system has changed over time. The creation of money through credit plays a key role in this.

In order to understand the process of money creation, it is necessary to take a look at the past. From the former Gold Standard to the current FIAT system, a change has taken place. A look at the history and the process of money creation.

The beginning of the Gold Standard

In the history of money, various commodities have been used as money. Starting with shells, pearls, silver and gold. Gold and silver coins were used in parallel as means of payment, in order to make smaller units possible with the latter. Finally, these gold and silver coins were replaced with banknotes representing a claim to the gold.

The evolution from the direct use of gold as a means of payment to banknotes representing a claim to gold can be explained as follows: Larger quantities of gold were stored at a depository, which confirmed acceptance by means of depository receipts. The depository receipts were then used as gold-backed paper money. Since any person could redeem any of the depository receipts for gold at the depository, the receipt corresponded to the actual value of the gold. The warehouse warrant is therefore not personalised and is thus referred to as a “money substitute”.

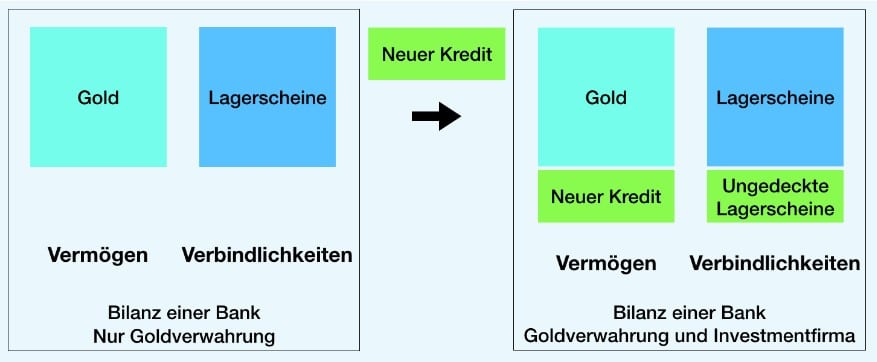

In principle, depositaries have the possibility to issue more depository receipts than they hold gold. These depository receipts are referred to as “uncovered depository receipts”. In the past, this has often happened. This has far-reaching consequences: When customers of the depository learn about it, they lose confidence in the depository. These customers then quickly redeem their depository receipts in order to secure their gold and thus their possession. Those who do so last will not receive any more gold, as the depository is already empty. This is the reason for so-called “bank runs”.

At the end of the 19th century, governments established the coverage of paper money by gold. Such a monetary system is called the “gold standard”. It was based on the obligation to redeem banknotes, which means that banknotes must be exchanged for gold at any time at the request of the population. During the First World War, warring governments issued uncovered banknotes to finance the war. As a result, the obligation to redeem banknotes was suspended in order to prevent a bank run. This excessive printing of uncovered paper money was the cause of the subsequent inflation. Before the further history of money is told with the introduction of the next gold standard, a basic understanding of the process of issuing uncovered storage notes is first established. This requires a closer look into the process of issuing loans.

Lending during the gold standard

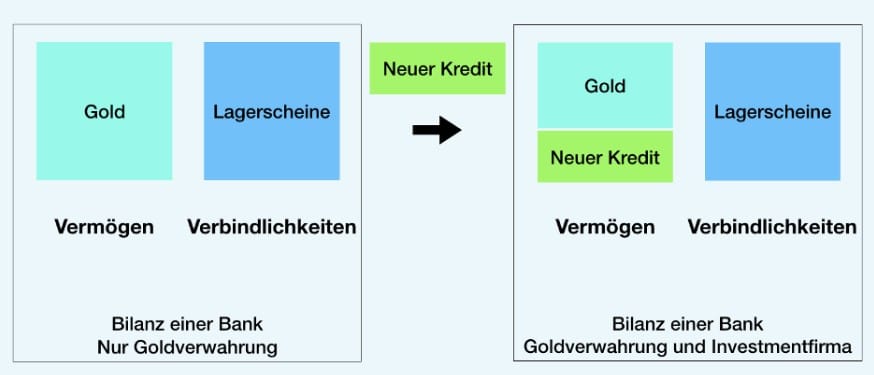

Larger quantities of gold were usually held in custody at a bank that performed the above-mentioned function of depositary. In addition to the business of custody, banks also pursued other activities such as granting loans. Banks thus acted as investment vehicles. This is highly relevant for the further analysis. First of all, it should be noted that for other investment firms, transparency is a top priority: investors need to know in which assets the firm invests their money, as investments always involve a certain degree of risk. This is still very limited in the case of banks. In the eyes of many observers, the separation of savers’ deposits and banks’ own investments is urgently needed to ensure transparency for the investor.

During the original gold standard, the bank granted loans with the money of its customers, to whom it paid interest in return. This corresponds to the transfer of money from the investor (customer of the bank) via the investment vehicle (bank) to the investment (borrower) as known from venture capital or private equity funds. This new loan is then part of the bank’s assets, as the bank is entitled to the loan amount plus interest. Part of the interest is paid by the bank to the actual lenders of the loan – the savers. This corresponds to the interest on the savings in our current system. The savings deposit is a liability from the point of view of the bank, as the bank insures that the credit balance will be paid out when required.

The above process describes the gold standard where no uncovered warehouse warrants are issued – one could call it the “original” gold standard. However, as mentioned above, banks have already issued uncovered depository receipts during the gold standard. These uncovered depository receipts were mostly issued in the lending process. Specifically, the borrower was not issued gold, but uncovered warehouse warrants. Money from nowhere” was created, because these warehouse warrants were not covered with gold. The process is illustrated in the next diagram.

The fraud is not conspicuous as long as the bank’s customers do not reclaim their gold in large amounts. No more gold may be claimed from the depository receipt holders than the custodian can service with his gold. If more depository receipts are claimed than are covered by gold, the custodian can no longer service its liabilities to savers and goes into insolvency. This usually happens during a bank run.

When the fraudulent behaviour of some banks became known, other banks refused to accept their depository receipts. The mistrust about whether these warehouse receipts are actually covered with gold increased. The Federal Reserve System has “remedied” this situation. Banks whose fraudulent behaviour was exposed could then be “rescued” by a central bank. This means that the banks were able to issue uncovered warehouse warrants without being stopped. The following are the Federal Reserve’s words about its function:

“Mit der Schaffung des Federal-Reserve-Systems beabsichtigte der Kongress, die schweren Finanzkrisen zu beseitigen, die die Nation periodisch heimgesucht hatten, insbesondere die Art von Finanzpanik, die 1907 auftrat. Während dieser Episode wurden die Zahlungen im ganzen Land unterbrochen, weil viele Banken und Clearingstellen sich weigerten, Schecks anzunehmen, die auf bestimmte andere Banken gezogen worden waren, eine Praxis, die zum Scheitern, ansonsten zahlungsfähiger Banken, beitrug. Um diese Probleme anzugehen, erteilte der Kongress dem Federal Reserve System die Befugnis, ein landesweites Scheck-Clearing-System einzurichten”. (Quelle: Federal Reserve System Publication, Purposes and Functions)

Money creation in the Fiat System

During the gold standard, the practice of issuing uncovered warehouse warrants was common. The central banking system provided a special incentive for this. From 1944-1973, during the so-called “Bretton Woods System”, the US dollar was tied to gold. In this system, USD 35 corresponded to one ounce of gold. The system fell apart precisely because of uncovered storage bills: More US dollars were created than the Federal Reserve Bank of the United States had gold in custody for. These US dollars corresponded to the “uncovered depository receipts”. The textbooks say that the Bretton Woods system fell apart because of “trust problems” and “speculative attacks”. By this design of the facts, the public was blamed for the collapse of the system. In fact, this loss of confidence was justified because the US Federal Reserve had created more US dollars than could be backed by gold.

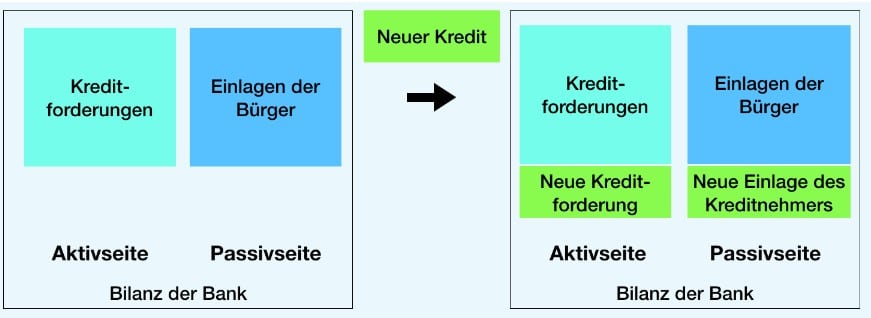

Currently, money is no longer tied to any underlying asset – the respective currencies have become so-called “fiat money”. The term “fiat” comes from Latin and means “it is done”. In this fiat system, the practice of creating money from nothing is common banking practice. Below is a diagram that explains the process of lending in the Fiat System. The process is analogous to the issuance of uncovered warehouse bills in the gold standard: the loan amount is simply added to both sides of the balance sheet. The money is not transferred, but is created from nothing.

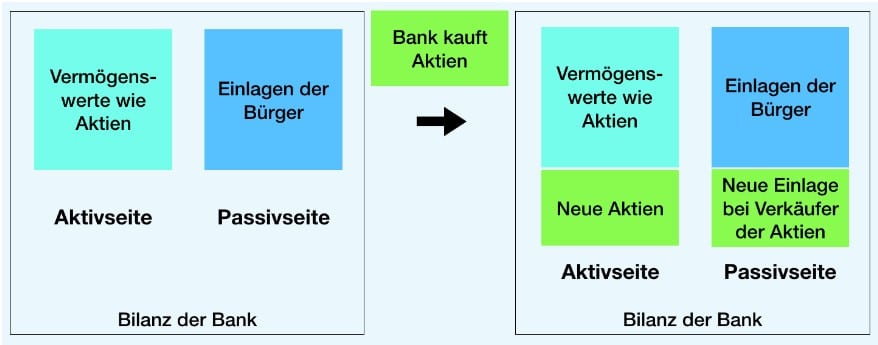

Banks can create money out of nothing not only in the process of lending, but also when they buy assets. The value of the asset is noted on the bank’s asset side and the money is credited to the seller’s account. This money is not transferred, but created from nothing – analogous to the process of lending. Corresponding articles on the processes can also be viewed directly on the websites of the German and English central banks.

Monetary systems in which money cannot be created from nothing

The monopoly of creating money out of nothing primarily contradicts the right to property. Savings dwindle in value due to the money creation process described above. Assets such as real estate become unaffordable for many people due to inflation as purchasing power dwindles. The artificial central banking system leads to negative consequences for the economy such as boom and bust cycles, misallocation of resources and asset price bubbles. The question arises: How can such a system be changed or reversed? Here I would like to mention a (translated) quote from Buckminster Fuller:

“Change is not possible by fighting the existing reality. To really change anything, you need a new system that makes the old superfluous.” – To quote Buckminster Fuller

What can a new system look like that eliminates the weaknesses of the old system? First and foremost, it must no longer be possible to create money from nothing. This is the case with Bitcoin and Gold. As discussed in detail in this article, gold has fallen victim to the fraudulent behaviour of depositaries: Custodians have issued more depository receipts than they have gold in their possession. This is still possible now. However, a functioning gold standard requires the trustworthy behaviour of depositaries. History has taught us that many depositaries were simply not trustworthy, so we should learn from this past.

Bitcoins do not require a custodian to send them over distance. Bitcoins can be sent to the recipient over the decentralized network without a central authority to trust. Bitcoin enables users to be financially sovereign themselves. “Only” the self-sovereignty of the owner is required. This includes a detailed study of this technology. A profound understanding of Bitcoin requires a critical examination of the most diverse areas of our lives: starting with economics, computer science, game theory, politics, law, and psychology.

*Originally published in German at CVJ.ch